Advisor Blog | Mar 2024

Analyzing "At Appointment" Equity Awards for New Directors

As some companies are considering this strategy to attract top-tier board talent, we offer prevalence data and the pros and cons.

As the competition for skilled and diverse outside directors intensifies, companies are considering innovative strategies to attract top-tier board talent. One such enticement gaining attention is the use of special "at appointment" equity grants. With the aim of refreshing and diversifying board memberships, these grants offer a way to distinguish a company's pay program in the recruitment process without a more costly increase to annual director pay levels.

The rationale behind at-appointment equity grants lies in their potential to immediately and substantially align directors with the interests of shareholders—beyond the more common practice of issuing a pro-rated portion of the standard annual board equity grants. However, the drawback is significant: These substantial one-time equity grants can draw the ire of shareholders and advisory firms—especially if perceived as excessive.

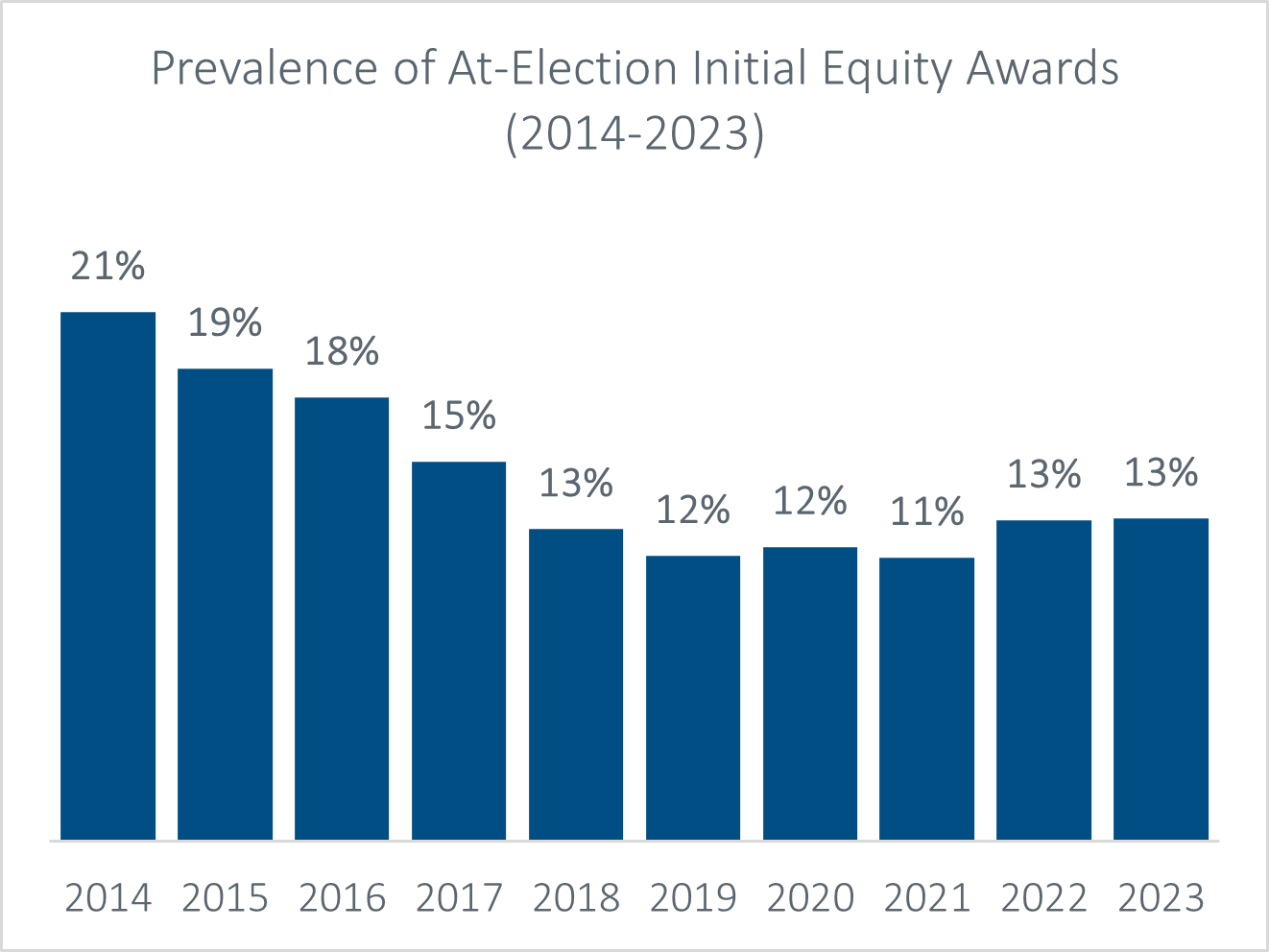

Prevalence Over Time

Data over the last decade reveals a decline in the use of at-appointment equity grants, dropping from 21% in 2014 to 13% in 2023.[1] While the decrease was sharpest from 2014 to 2018, prevalence has since leveled off. The question arises: Might we witness a rebound or increase as director competition intensifies?

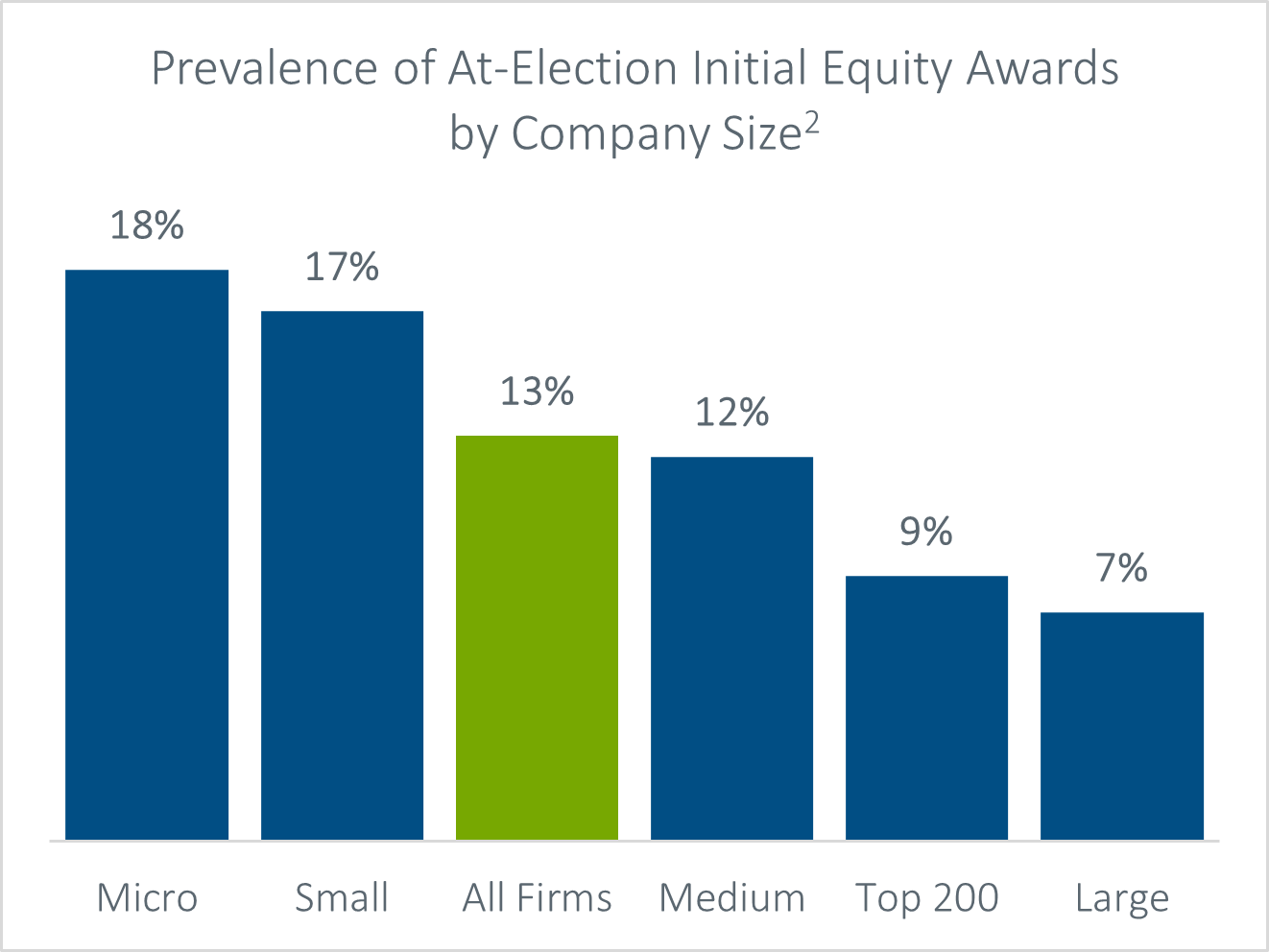

Relationship Between At-Appointment Equity Grants and Company Scale

Smaller companies lead in the utilization of at-appointment equity grants, with prevalence rates of 17% and 18% at small and micro companies, respectively, compared to less than 10% at larger counterparts.[2] This trend suggests that smaller companies may be competing for the same directors as larger firms, where appointments can be perceived as more prestigious or coveted. At smaller, emerging/high-growth companies, a substantial one-time equity grant can be particularly attractive due to its potential for higher upside.

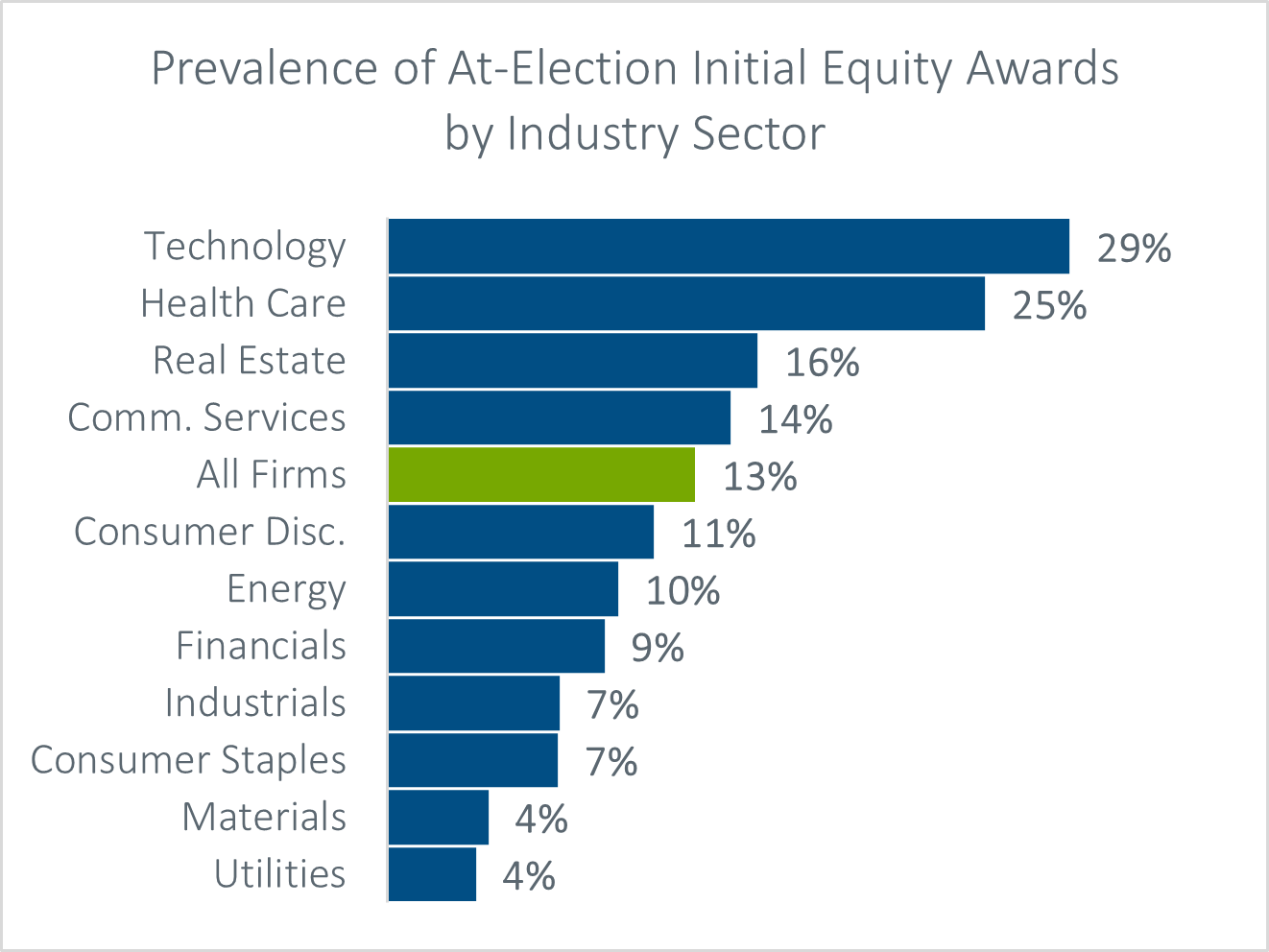

Prevalence of At-Appointment Equity Grants Across Different Sectors

Certain industries exhibit a higher prevalence of at-appointment equity grants. Notably, the information technology and healthcare sectors award at-appointment grants at rates of 29% and 25%, respectively, compared to the overall rate of 13%. Traditional sectors like industrials, materials, and utilities rarely offer such grants, potentially highlighting where the competition for outside directors is most intense.

Conclusion

While at-appointment equity grants can serve as a valuable tool to attract outside directors and immediately align their interests with those of stockholders, it remains a relatively uncommon practice. Prevalence varies based on company size and industry dynamics. Companies considering this approach should be prepared to defend the rationale for such grants against criticisms of outsized director pay. Additionally, those that elect to adopt such programs moving forward must balance perceptions of fairness among longstanding directors who may feel overlooked compared to new directors. As with so many corporate governance issues, in the evolving landscape of director compensation, balancing innovation with fairness is essential.

[1] Data in this article is sourced from the 2023/2024 Pearl Meyer/NACD Director Compensation Report covering 1400 public companies.

[2] Report data is divided into five company size categories based on annual revenue: Micro: $50M - $500M; Small: $500M - $1B; Medium: $1B - $2.5B; Large: $2.5B - $10B; Top 200: largest 200 companies in the S&P 500.