Article | Dec 2023 | National Affordable Housing Management Association

NAHMA 2023 Survey: Compensation and Human Capital Trends in Affordable Housing

The latest industry data show higher than normal base salary increases and broader use of short- and long-term incentives.

Recruiting and retaining top talent remain an ongoing industry challenge

2023 has been another challenging year for the affordable housing industry. Inflation, the dramatic rise in operational costs, and the ongoing talent drain to market-rate platforms has sparked employee-related challenges and an increasing shortage of professional talent in the industry. As a result, affordable housing firms continue to face difficult decisions with respect to their compensation and award philosophy and practice.

Given this context, there is a benefit to understanding current compensation levels, workforce trends in the broader industry, and how human capital issues are impacting operations. The 2023 Pearl Meyer NAHMA Affordable Housing Compensation Survey provides critically important information to guide salary budgeting and decision-making for 2024.

Based on that data, we see three main takeaways pertaining to base salaries, short-term incentive compensation (also known as “annual bonuses” or “STI”), and long-term incentive compensation (LTI). We’ll also explore three issues impacting human capital and business operations in the affordable housing industry.

Compensation Data

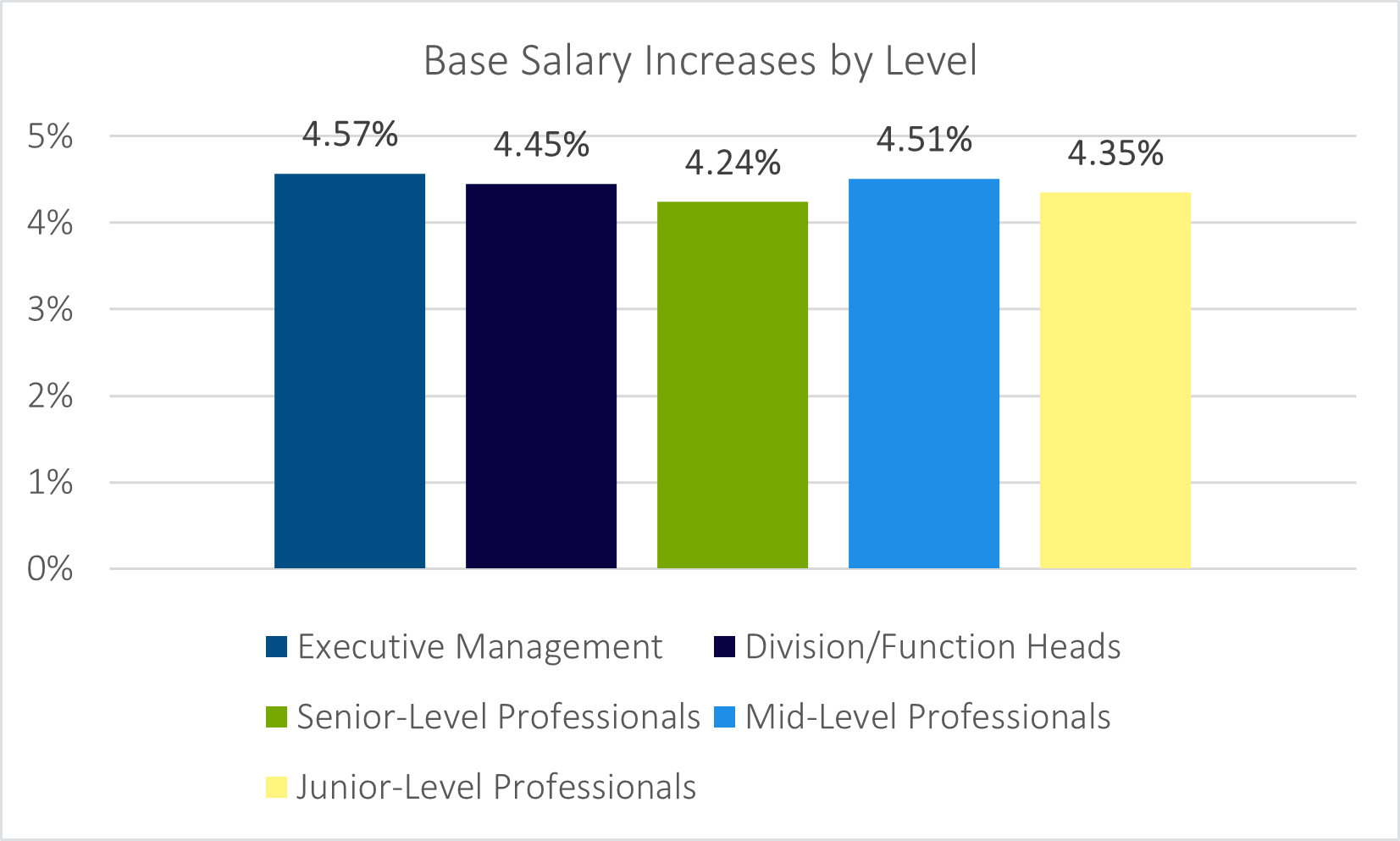

First, some findings from our survey with respect to base salaries. Traditionally, annual raises settle at between 2.5% and 3% across all levels of affordable housing-focused companies. Data indicated a larger jump across the board in 2022, with a range between 4% and just under 4.5% in year-over-year increases. This is chiefly due to the competitive pressure of retaining talent and was a jump mirrored by many other US industries. In 2023, the survey data paints a similar picture, with base salary increases ranging from 4.24% to 4.57% across all professional levels.

Executive management and mid-level talent, on average, have received a larger year-over-year boost in base salary compared to other professional levels, but all are relatively close in year-over-year increase percentages.

In 2024, inflation may continue to drive another round of 4% jumps in base salaries. However, we may be nearing a tipping point where operational increases in fixed costs will necessitate more selective increases to reward true difference-makers and/or specialists who may be extremely difficult to replace, either from the time required to replace the role, the individual’s institutional knowledge, and/or their cultural impact on the company.

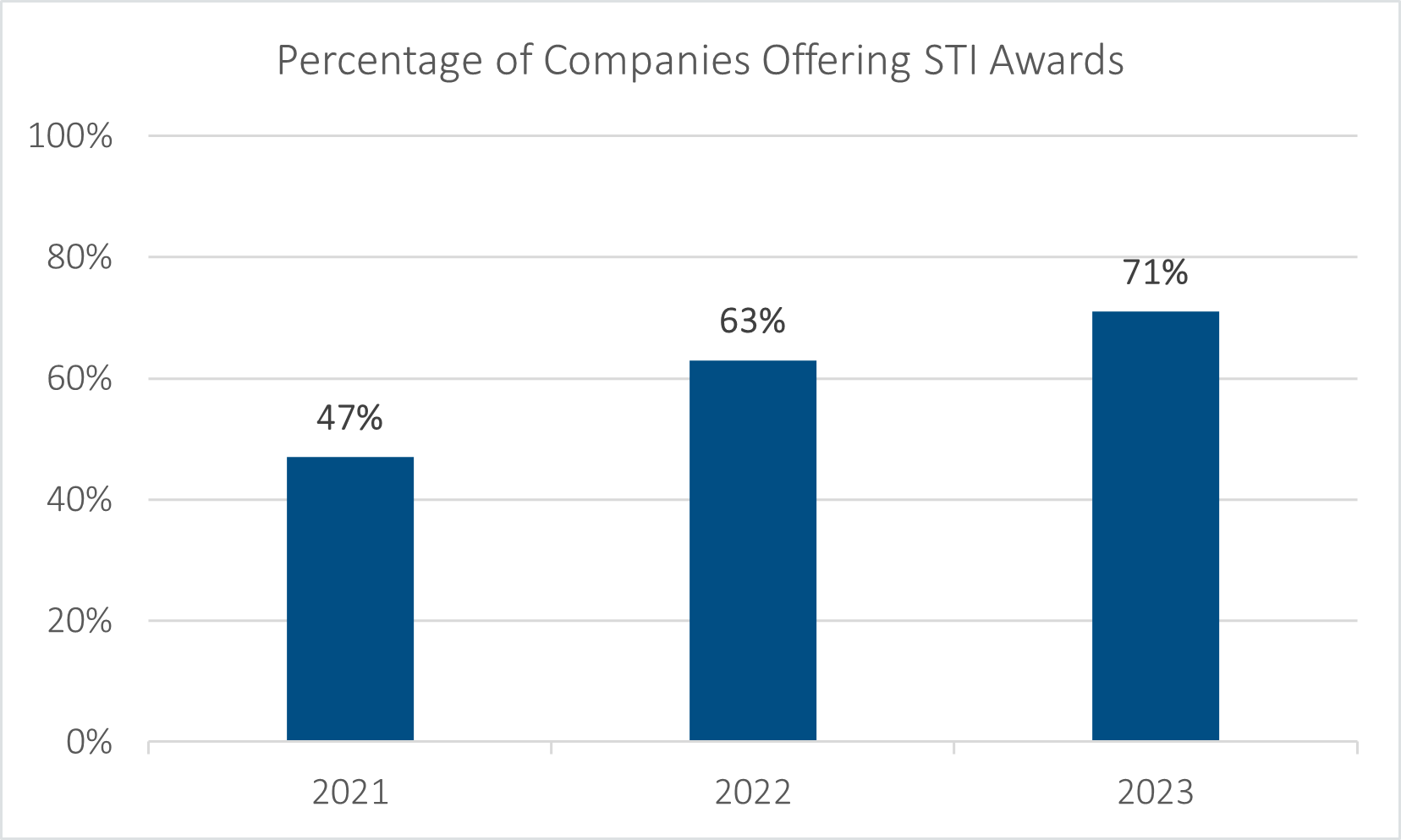

Short-term incentive awards are our next area of focus. In 2022, the affordable housing industry took major strides with respect to STI awards. That survey showed a year-over-year increase with 16% of firms in the industry now offering short-term incentive awards to their professional and support teams. The trend continues as further adoption of STI becomes a standard practice, gaining favor in the affordable housing industry. 2023 survey data show 71% of all affordable housing firms now offer this component of compensation to their professionals.

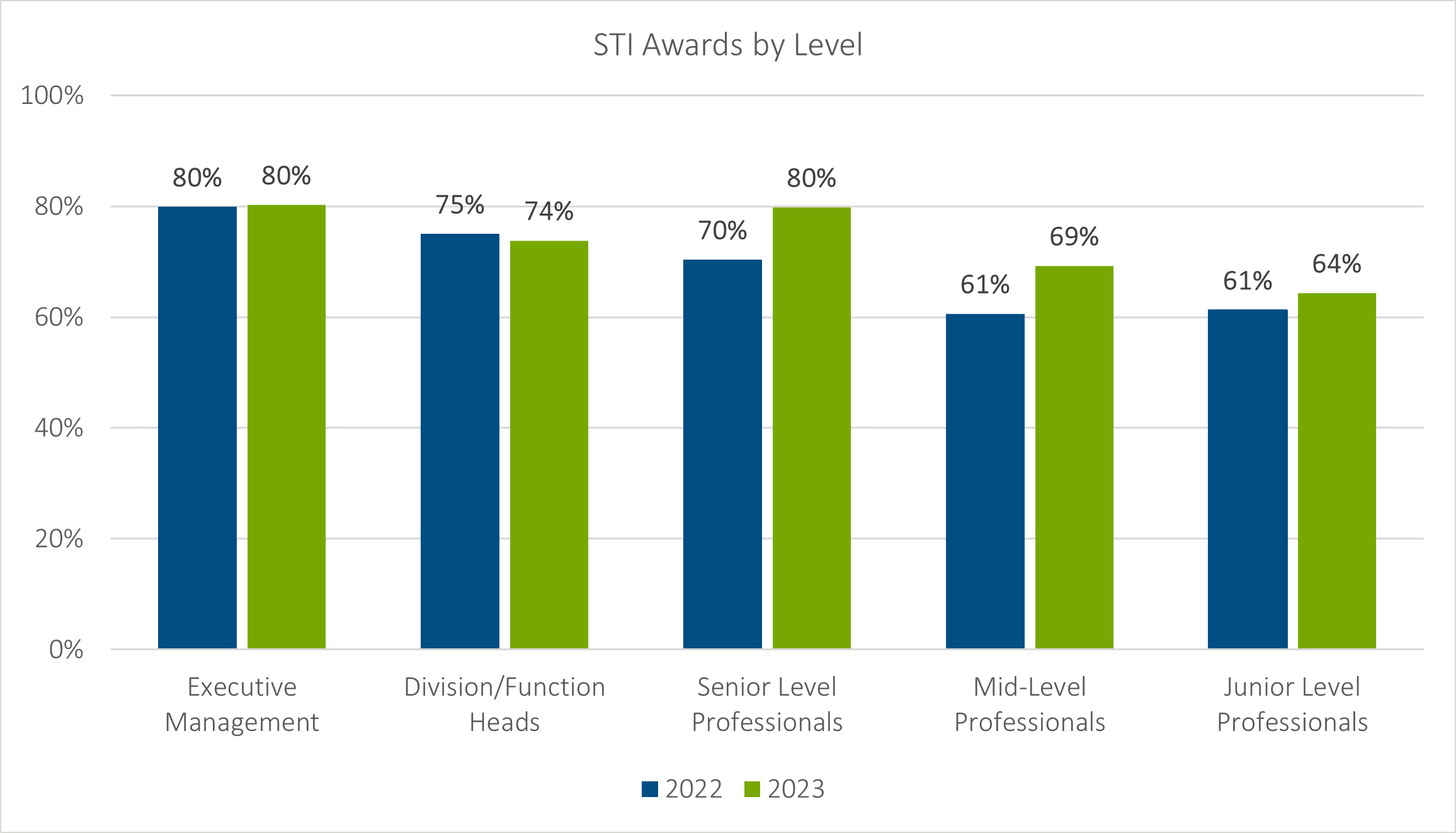

Furthermore, an increase in the use of STI awards is happening throughout the company, with almost two-thirds of junior-level professionals qualifying for STI awards from firms who utilize this component as part of their pay mix. We expect this trend will continue.

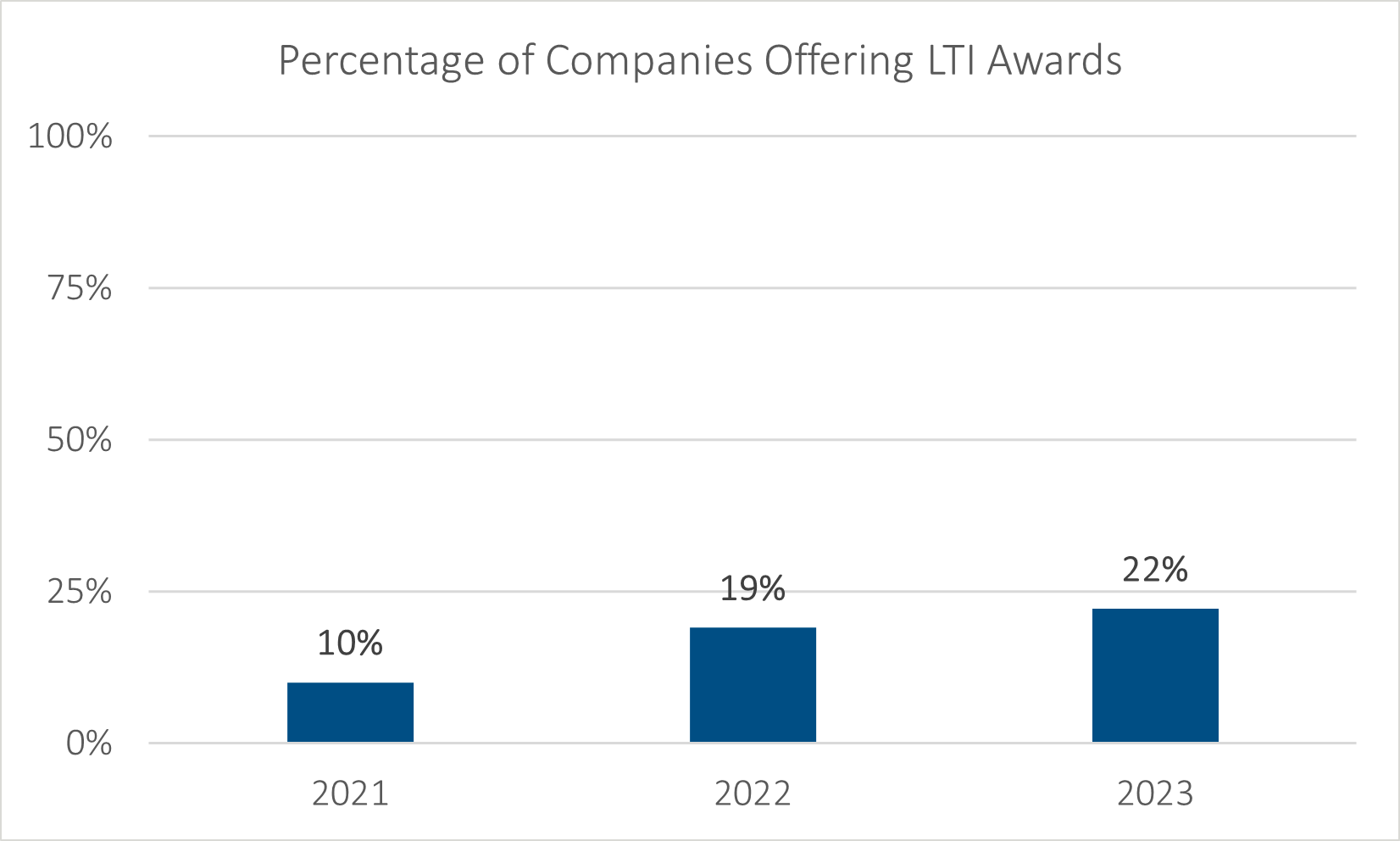

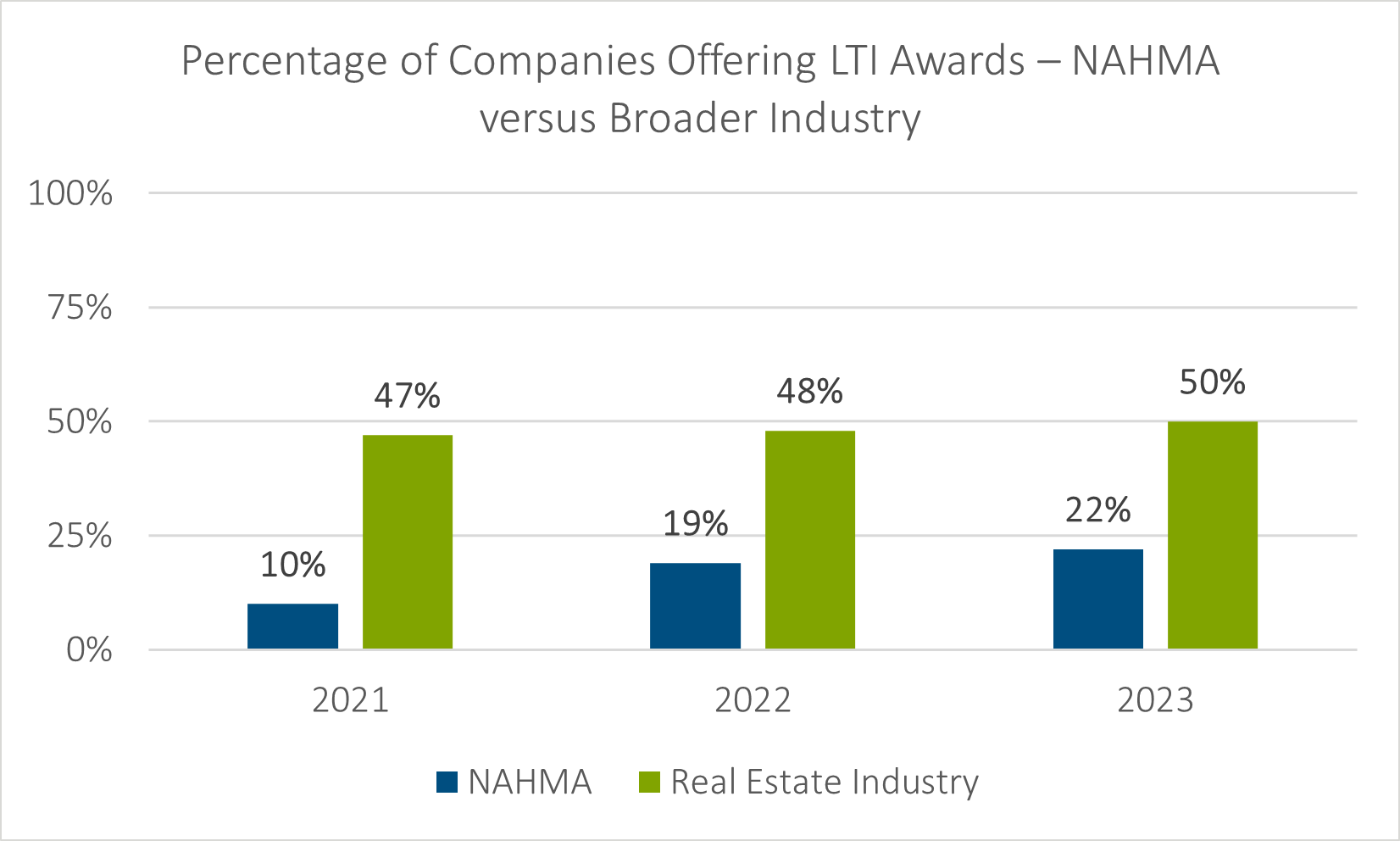

There has also been a move forward in the ever-growing number of firms utilizing LTI in compensation design. Since 2021, the use of LTI plans in the affordable housing industry has increased from 10% to 22%, with signs of further growth in 2024. This is further evidence that affordable housing firms recognize they are competing against the broader real estate industry for talent and that they must attempt wherever possible to provide a like-kind financial arrangement for their professionals. With an LTI plan in place, there is both financial incentive for employees to stay with the organization for a longer period of time, as well as an incentive for the executive team to achieve multiple strategic and financial milestones for the organization.

Once a decision is made to implement LTI, the next decision is who is eligible. Most often, executive management, and frequently, division and/or functional heads participate in LTI plans. However, there is a small but growing trend year-over-year that shows companies are increasingly pushing LTI awards further down in the organization to more junior-level professionals. Approximately 15% of firms in the broader real estate sector currently offer LTI to all members of their respective professional teams, and it is expected this will also be a growing trend within the affordable housing sector.

Broad Workforce Trends

1. Job titling issues are becoming more prevalent and at an increasingly aggressive pace.

Pearl Meyer also conducted a 2023 survey focused on job titling practices which found that small private organizations, similar to many in this industry, have significantly increased the rate at which they use job titles to attract, reward, and retain employees. The rate of this behavior has increased materially in the past five years.

Furthermore, nearly 20% of the survey respondents reported the regular use of “unconventional” titles. While aggressive title practices can be an effective short-term tool in the effort to reward and retain talent, particularly in the case where there are capital constraints, the long-term damage to organizational structure, strain on company morale, and other related issues can quickly become a real headache and lead to difficult consequences.

For the sake of preserving pay equity, maintaining logical pay bands and an organizational structure that allows for responsible growth is the best path forward. For those companies that have dabbled in creative titling versus competitive compensation, pulling back on the reins is important for the long-term health of the company.

2. Firms are requiring a return to the office, like it or not.

Many industry professionals in the field have lived on-site before, through, and after the pandemic, but for those in the corporate ranks with a central office reporting location, the migration back to the office is nearing pre-pandemic levels.

In 2022, my discussions with CEOs and other executives leaned heavily in the direction of a three-days per week in the office requirement. However, late in 2022 and continuing into and through 2023, there has been a growing demand for employees to return on a four-day a week basis and many of these executives are frequently asking if five days a week can ever come back.

Companies increasing the in-office requirement need to recognize that employees may perceive this as removing an important benefit. This can be somewhat mitigated if the executives and senior management are leading by example and returning consistently to the office on a daily basis.

3. CEO are retiring and mergers, sales, and consolidations are on the rise as a result.

There appear to be an increasing number of mergers and consolidations in this industry as a generation of founders, owners, investors, and operators look to transition out of their active day-to-day leadership roles.

At issue in many of these cases is the lack a clearly developed internal succession plan. Without suitable internal candidate options to fill the executive chairs, companies risk overpaying for a capable, but unknown, external candidate or resorting to buyout offers from firms with proven multi-generational executive teams in place. Given that a successful succession process typically takes between three and seven years, developing a sound succession strategy now with a process for continually managing its milestones is highly recommended.

Conclusion

The affordable housing industry continues to work toward closing its gaps with market rate and other broader real estate firms, primarily through the increased use of both short- and long-term incentive components in tailored compensation packages. The affordable housing firms that still find themselves without a bonus component run the increasing risk of falling further behind their competitors and having difficulty attracting and retaining high caliber talent. The forward-thinking firms will continue to provide compelling compensation solutions and rewarding work environments. 2024 will likely represent more of a return to “normalcy,” with companies continuing to welcome back their respective workforce in a common office to achieve their firms goals and objectives.