Article | Jan 2025 |

NAHMA 2024 Compensation Survey Takeaways

The cost to hire and retain difference-making talent makes an aggressive jump.

Living through an inflationary climate in 2024 has had a direct and impactful effect on the bottom line for affordable housing companies, as the cost of hiring and retaining talent has risen dramatically in the past year. Nowhere is it more evident than in the entry- to early-level talent segment of these organizations, which are a critically important constituency that helps ensure long-term, sustainable growth.

Data from the recently completed Pearl Meyer 2024 Affordable Housing survey, sponsored by NAHMA, provides information on more than 100 unique positions, as well as a sense of industry trends and movement with respect to compensation-related issues affecting affordable housing companies.

Key Takeaway 1: Base salaries made a material jump.

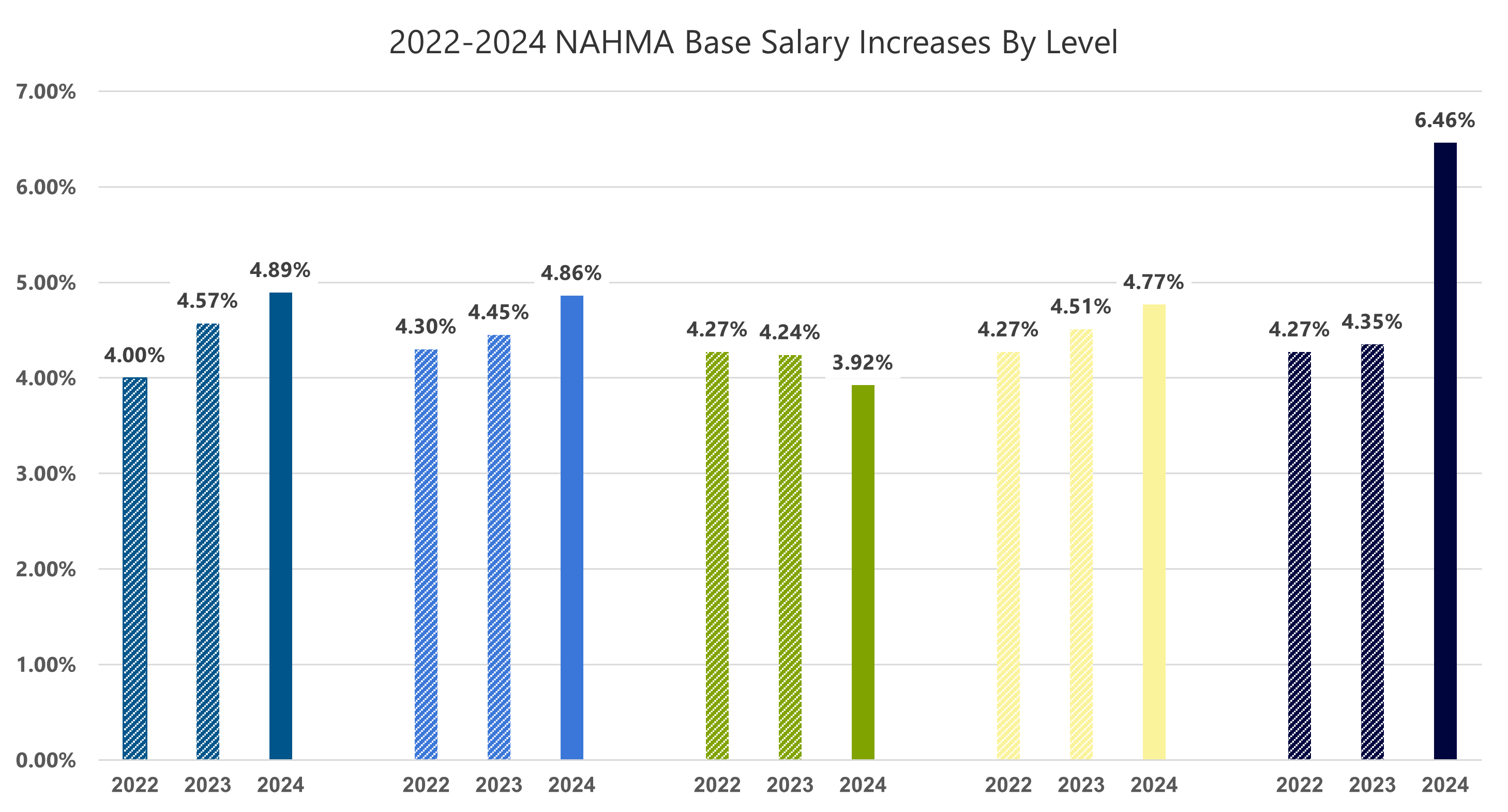

2024 survey results show that base salary upward movement in 2024 reflects the current inflationary climate. The results overall show more aggressive increases than in 2023, with base salary increases up on average from 4.21% to 4.76% across all levels. Data show a blended average (the average rate increase across all levels within the company for a given year) increase of 4.5% in 2023 and an approximately 4.2% blended increase in 2022. This is in comparison to an approximately 3% average increase in 2021. In 2024, base salaries have a blended increase of 4.98%. These results reflect the need to keep pace with the broader real estate and professional markets where 4.5% to 5% year-over-year base pay raises have become the recent norm.

While the aggressive increase in base salaries is of note, the real outlier is found with an increase in base salary for junior-level professionals of 6.46%. This confirms a recent trend where firms are fighting for an increasingly limited amount of entry-level talent and are more willing than in recent memory to go materially above market to secure these professionals.

Turnover created by relatively new employees moving between organizations drives up the replacement costs and companies will need to find methods to develop and secure the junior level while also dissuading any desire to “test the market” in terms of compensation. Developing loyalty by way of rewarding retention strategies will be an opportunity for optimally managed companies to maintain their competitive edge.

On a broader scale, given the rise of operational expenses and other economic challenges, the nearly 5% annual base salary increases across the organization will put more pressure on companies to produce stronger profit margins. Companies may need to consider how to be more selective with respect to annual and/or merit increases and lean toward paying difference-makers and/or hard-to-replace, uniquely qualified professionals.

Key Takeaway 2: Annual bonus awards became increasingly prevalent within the affordable housing industry.

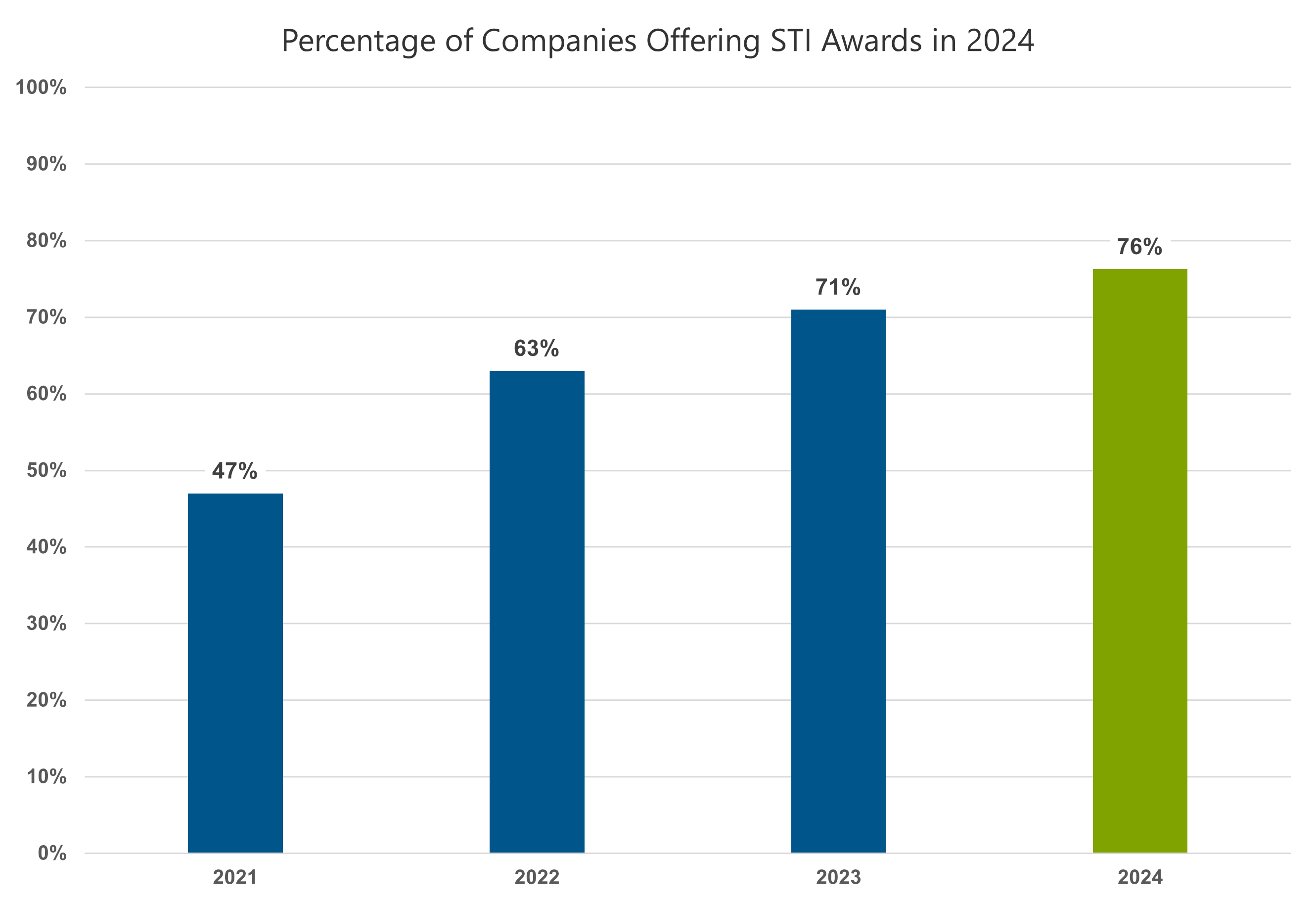

In 2024, an ever-increasing number of affordable housing firms implemented annual bonus programs. Just three years ago, less than half of the industry (47%) was offering short-term incentive (STI) bonus awards. In 2022, the industry took a material jump in STI award-granting, up from almost half (47%) to nearly two-thirds (63%) offering an annual bonus to their professionals.

In 2023, the industry further climbed to 71% adoption, and in 2024, that number rose again to 76%—substantially closing the gap between affordable housing and the broader real estate industry, where short-term incentive awards are offered at 93% of companies.

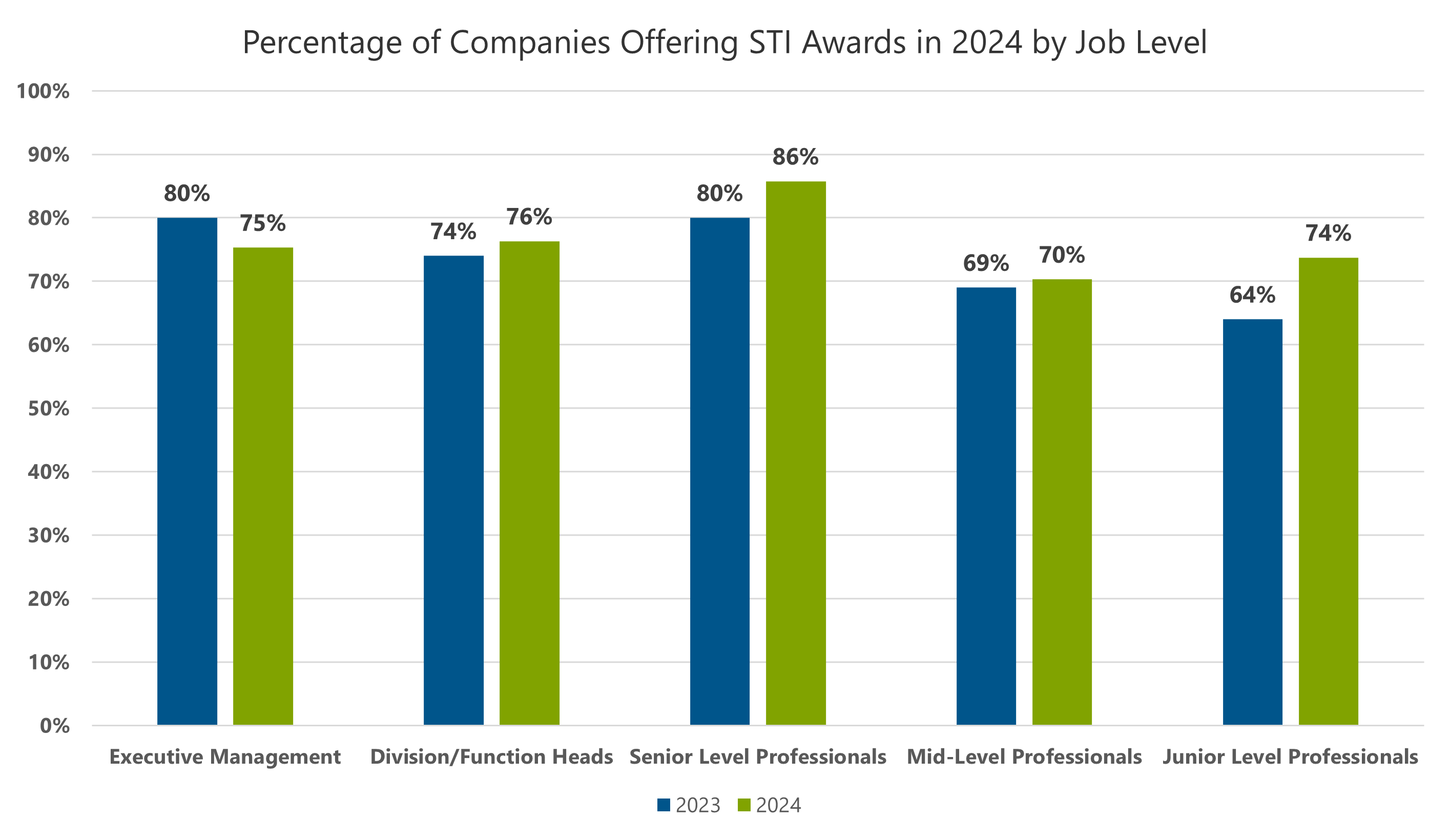

Beyond prevalence, it is telling to see which employee populations are receiving these annual bonus awards. While almost all of the executive team enjoys participation in short-term incentive award programs, increasingly, firms are extending these awards down and throughout their professional and even support functions both at corporate offices and on-site. The survey results show an uptick in participation for all levels, except executives, and notably the highest increase is at the junior level.

The survey shows a slight dip in STI among the executive team which is likely due to several firms decreasing annual award participation for a greater stake in equity or long-term compensation potential.

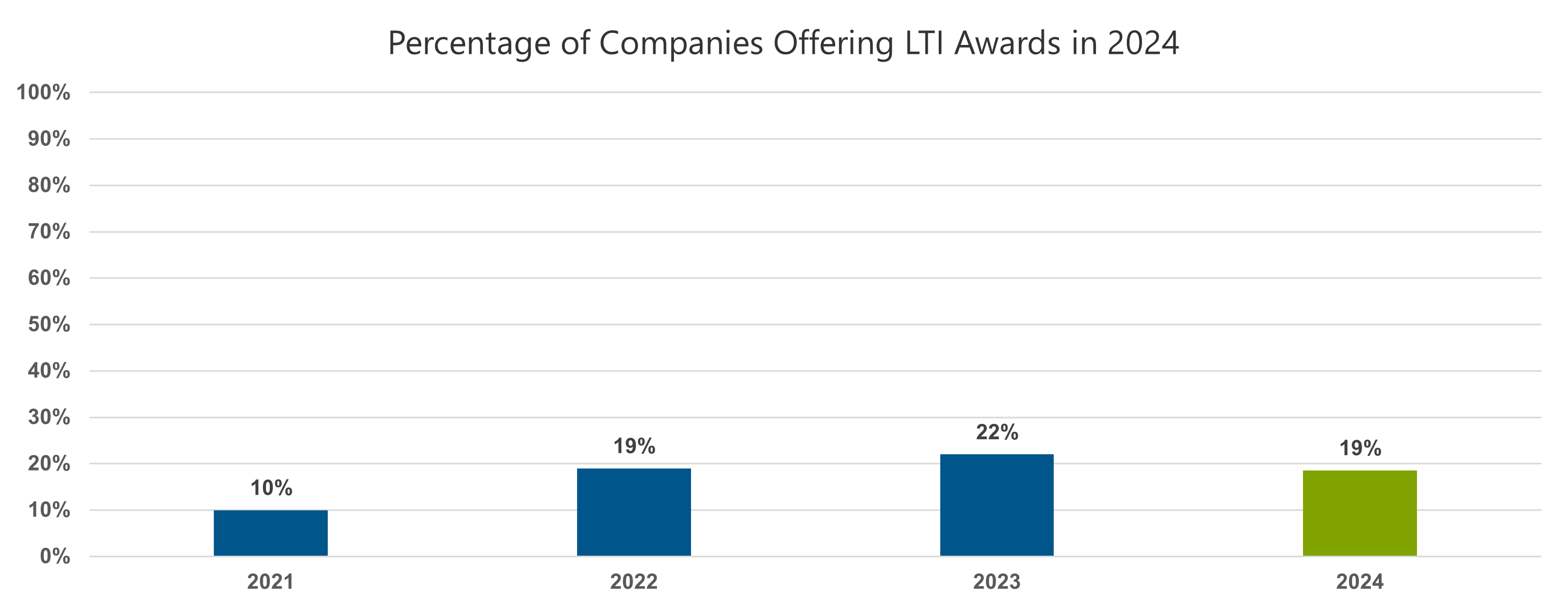

Key Takeaway 3: The adoption of LTI award programs in the affordable housing industry has taken a momentary pause in adoption rate, but is still significantly higher than in 2021.

A long-term incentive (LTI) component offered to affordable housing industry executives dipped slightly from 22% in 2023 to 19% in 2024. However, these figures represent a rough doubling of LTI prevalence since 2021. This is a similar trend we see in other real estate sectors including multifamily, homebuilders, and the commercial and industrial sectors.

The companies that have the ability to offer LTI compensation will enjoy both a recruiting benefit as well as an increasingly meaningful retention advantage. And given the shortages of difference-making talent in key areas, retention will become an increasingly critical objective for firms seeking to grow and prosper.

Conclusion: The 2024 survey results magnify the importance of attracting, retaining, and engaging “difference-making” talent at all levels.

This year’s survey shows an eye-catching rise in year-over-year pricing for junior professional talent. In many instances, this professional group began their careers under the work-from-home pandemic time period, while others quickly became accustomed to that environment.

As firms have returned to the office, many Gen Z employees are increasingly questioning career choices and direction. Companies that employ young professionals need to do so with a plan in mind that encourages engagement, involvement, and ways to enhance skills and develop over time. These younger employees need to see tangible evidence of this care and attention or they are likely to leave.

Companies also feel the increasing pressure to establish mid- to long-range professional goals with more senior employees and build a sense of purpose and belonging—one that communicates a sense of loyalty to the organization will, over time, be fairly rewarded.

We recommend that forward-thinking organizations develop a comprehensive plan and commit the time and resources necessary to lock in promising talent. It will be the number one method to future-proof an organization.