Article | Nov 2020

Ready, Set, IPO: A Three-Part Plan for Executive Compensation

An IPO means major change for your pay programs and corporate governance; we outline three key areas that can help structure the planning process.

An IPO is an important step in a company’s evolution that brings big changes in the approach to compensation and overall governance. It marks the first time that a company’s compensation programs, practices, and decisions are made public through various filings with the Securities and Exchange Commission (SEC). Proper planning, a well-designed framework, and good execution can help the company decide upon, and implement, programs that can withstand public company scrutiny, provide proper flexibility, and aid in achieving desired objectives.

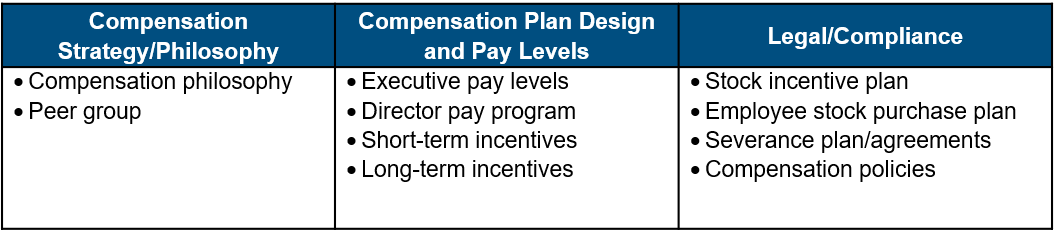

To reach that state, decisions in three key areas are required based on a combination of what the company is trying to accomplish and what is reasonable from a marketplace perspective.

Compensation Strategy/Philosophy

A foundational aspect of an effective compensation program is the development of a compensation strategy and philosophy. What is the company trying to accomplish through the programs, what should be done differently than others to create a competitive advantage through compensation, and who should be included in the market comparison group?

- Compensation Philosophy: A statement of beliefs and objectives around compensation (or total rewards) that guides plan designs and compensation decisions at the company. Often accomplished or articulated through a combination of the working team’s view and perspectives, and interviews of key executives and directors at the company.

- Peer Group: To understand the market for a variety of different benchmarking exercises, it is critical that a peer group is developed and agreed upon. The process of developing a set of comparator companies may differ by industry but should generally consider basic criteria like size and industry, and also more sophisticated characteristics like operating complexity and other industry-specific traits. Depending on the industry, it may also be possible to identify a subset of companies in the group that also recently conducted an IPO, which can clarify certain competitive practices at or around the time of the offering.

Compensation Levels and Plan Design

Depending on a company’s fiscal year-end and the time of year that the IPO is completed, this step can include varying components. At a minimum, it is important that a public company Board of Director pay program is determined, and that executive pay levels are reviewed for competitiveness and consistency with the company’s newly articulated philosophy. In certain cases, it may also be appropriate to review the cash bonus plan in place, particularly if the IPO coincides with a new plan year. Similarly, the company may also want to design a new long-term incentive program for either IPO related grants, or a new plan cycle.

- Executive Pay Levels: Understanding the current competitiveness of executive pay arrangements relative to the market is necessary to understand if any significant gaps exist, and to begin to plan how to close any gaps as needed. This step is also critical for understanding how public companies pay their executives—it is common that when companies move from privately held to publicly traded, there is an evolution of the cash and equity mix in the first few years after the transaction.

- Director Compensation: Developing a strategic director compensation program goes hand in hand with bringing on new independent directors to the company’s board in anticipation of an IPO. They will want to know what the compensation arrangement will be as a public company. Additionally, this new director compensation policy is often disclosed as part of the IPO prospectus.

- Short-Term Incentive Design: Prior to the IPO, the short-term incentive (STI) programs may need review to ensure optimal alignment with company strategy and market expectations for a public company. Pre-IPO companies in some cases have multiple plans outstanding, some of which will target different metrics across the organization. A compensation advisor will not only review the plans to ensure that their structures are complementary and supportive of company goals, they will also verify design consistency with public company practice. Excessive use of discretion in annual payouts is one area that must often be addressed, as is payout leverage and appropriate goal-setting.

- Long-Term Incentive Strategy: Arguably the most important area to address pre-IPO is long-term incentives (LTI), which often comprise the largest component of executive compensation. As such, it’s critical for newly public companies to have a clearly defined LTI strategy. As a first step, companies and their advisors should use the information obtained from the competitive pay assessment to evaluate whether existing equity holdings are sufficient to ensure retention of key executive through the transaction. If not, IPO equity awards made in conjunction with the offering should be considered, along with modeling future equity retention power to highlight potential areas of vulnerability over the next 12 to 24 months. The LTI strategy should also encompass the post-IPO equity structure. Stock options are the most common equity vehicle for pre-IPO companies, whereas many public companies award a mix of stock options and restricted stock units (RSUs) to assist with ongoing retention. Vesting parameters may also need recalibrating. While performance-based equity is also prevalent, in most cases companies will evolve towards this type of grant as the company matures.

Legal and Compliance Focus Areas

Compensation advisors, in conjunction with legal counsel, will work with pre-IPO companies to ensure that key legal and compliance aspects of compensation are properly addressed prior to the IPO. A complete review of the vast legal and compliance issues is beyond the scope of this article, although a broad view of the most important areas includes:

- Stock Incentive Plan: It is a universal exercise to develop a new stock incentive plan that serves as a guiding legal plan document for issuing equity and cash incentives as a public company. This document is part of the prospectus filing for investors and made public through the SEC. As such, it is critical to have this be completed in advance of the IPO. A company should work with their compensation advisor to benchmark certain compensatory aspects of the plan itself, and with outside counsel to advise on the legal aspects of the plan and draft the actual plan documents. Some of the key compensation-related aspects of this plan would be the pool of shares to be made available as a public company for grants to employees and outside directors, and the potential adoption of an evergreen share replenishment provision for certain high growth sectors.

- Employee Stock Purchase Plan (ESPP): Similar to the stock incentive plan, and ESPP is another legal document that companies often will include in the prospectus filing for implementation at or after the IPO. This plan provides eligible employees the option to purchase shares of company stock, often at a discount to the trading price. Unlike the stock incentive plan that is virtually universal, ESPPs have differing prevalence levels depending on industry, so incorporating an upfront decision as to whether an ESPP will be put in place is critical.

- Executive Employment Contracts: While prevalence can be mixed based on sector, some companies choose to implement or review executive employment contracts to ensure competitiveness with public company practices. An evaluation of the compensation-related aspects of the agreements usually covers any disclosed salary, bonus or equity terms, and executive benefits related to various separation events (e.g., involuntary termination).

- Severance Plan: Company severance plans provide more broad-based employee protections as a result of involuntary termination or change-in-control (CIC)-related termination. They’re also a way to provide severance protections at companies which choose not to maintain employment contracts with their executives. Severance plans typically offer a framework for salary and benefits continuation after qualifying termination, as well as an approach for determining potential bonus payouts and treatment of unvested equity awards after termination.

- Compensation Policies and Disclosure: Corporate governance best practices have evolved significantly over the last ten years, largely as a result of the Dodd Frank Act and shareholder advisory groups which have worked to raise awareness. Compensation policies on the clawback of incentive compensation, executive stock ownership guidelines, or a prohibition on executive hedging are now commonplace and, in some cases, required. Pre-IPO companies should ensure the right policies and procedures are in place before or soon after the IPO.

It’s also important for pre-IPO companies to understand their disclosure requirements as a newly public company. Most pre-IPO companies avail themselves of the Emerging Growth Company (EGC) designation which, as part of the 2012 JOBS Act, provides an easier on-ramp for newly public companies by requiring less robust compensation disclosures for five years after the IPO, provided they continue to operate within certain parameters. Perhaps most importantly from a compensation standpoint, EGCs are not required to file a Compensation Discussion & Analysis (CD&A) which removes a significant disclosure burden in the early stages for newly public companies.

Looking Ahead

Once the IPO has taken place, management and the compensation committee should work quickly to get in sync with the annual planning calendar. Since IPOs often occur mid-fiscal-year, there likely are some immediate items to address. In addition to routine annual items, there are also human capital and organizational development initiatives that the company should embark on sooner rather than later, including:

- Leadership Development and Succession Planning: This often-overlooked area of human capital planning is occupying more and more time among public company boards and executive teams. Succession planning at the executive level often falls under the compensation committee’s purview but may also be managed by the nominating and governance committee. Regardless, it’s important that there’s a proactive strategy to identify and develop the company’s next generation of leaders to ensure proper continuity, either at a strategic point in time or in an emergency situation.

- Organizational Health Measurement: This includes overall workforce talent management and engagement. With increasing emphasis on stakeholder capitalism, additional company focus on environmental, social, and governance (ESG) initiatives, including diversity, equity, and inclusion, is becoming an area of great interest for shareholders. Defining appropriate and quantifiable measures which are important to the organization will be important for articulating progress in these areas. While these disclosures are not yet required, more and more companies are choosing to provide them as part of investor presentations or within the CD&A narrative.

Communication Brings it All Together

Effective internal communications around compensation, rewards philosophy, and ESG is key in maximizing the value of the incentive plans, and for attracting and retaining a generation of employees who rank organizational purpose higher up the list of what they look for in an employer than ever before.

Externally, newly public companies face the added pressure of regular correspondence with shareholders, proxy advisory firms, and regulatory agencies. When it comes to communicating compensation philosophy, pay decisions, and how they relate to organizational purpose, bear in mind the multitude of audiences and that this exercise is a balance in meeting public company requirements and effectively engaging with constituents.

Every IPO is different and, while most companies will touch on most of the areas above, the roadmap is most effective when viewed as a whole. It should be tailored to each company’s unique situation and getting started sooner rather than later will help the company better prepare for hurdles that will inevitably crop up along the journey to IPO.