Article | Dec 2022

Sizing Up Retention and Transaction Bonus Pools

As a merger, acquisition, or sale takes shape, whether and how much to pay for bonuses is a key decision point for compensation committees.

Feb. 24, 2025: Pearl Meyer is currently conducting a survey on M&A transaction and retention bonuses. If your company has undergone a transaction within the last three years and you would like to participate in this survey and receive the resulting data report, please contact Adam Kahle or Aalap Shah.

Employee anxiety can run high when it becomes apparent that a change-in control (CIC), merger, acquisition, or sale of a business is in sight. Boards face heightened risks that management and key talent will flee or be poached by competitors.

Each transaction being considered can have an impact on whether existing compensation programs will remain sufficient to keep talent in place through the uncertainty. When equity grants have been made annually and a company’s stock price has risen significantly over the past several years, current equity holdings may be sufficient to retain the equity participants. But if the share price has declined significantly, leaving equity awards with little value, management and key employees may not perceive much benefit to sticking around.

The type of transaction (asset sale, stock sale, spin-off, etc.), and the buyer involved, whether it is a strategic buyer versus a private equity firm, for example, can also play a big part in determining the “stickiness” of current compensation arrangements. Financial buyers often intend to keep the existing management group post-transaction. Strategic buyers may target specific overlapping groups or functional areas for significant employee reductions. As a result, from the start of the M&A process, boards of target companies must stay alert to the effectiveness of their company’s current programs under a variety of potential M&A scenarios and adapt as the deal progresses.

Compensation committees often turn to retention and/or transaction bonus plans to supplement current compensation arrangements in transactions. These programs enable companies to retain key personnel through a transaction, on a targeted basis, for a targeted time period. Keeping the team in place can maximize shareholder value whether or not a transaction proceeds.

Understanding whether and how much to pay for retention and transaction bonuses is critically important for compensation committee members. To better understand how companies have sized retention and transaction bonuses in the M&A setting, Pearl Meyer and Main Data Group examined the “say-on-golden-parachute” (SOGP) disclosures of over 900 company transaction filings from 2016 to early 2022 (a dataset we refer to as the “M&A study group”), in transactions valued up to $100 billion. An overview of these programs and a summary of the SOGP research follow.

Retention Bonuses and Transaction Bonuses Explained

What are retention and transaction bonuses exactly? Companies often use the terms interchangeably, although they can have significantly different meanings.

Retention bonuses typically involve cash-based payments that are paid contingent upon continued services to a specified date. The awards can be structured to be paid regardless of whether the deal occurs, or upon completion of the deal and for some period thereafter (for example, vesting 50 percent at closing and 50 percent six or 12 months post-closing). Awards typically vest in the event the participant is terminated without cause during the retention period. In some cases, retention awards are issued in stock and vest over a period of several years.

There are two types of awards that are commonly referred to as transaction bonuses: deal support and value sharing.

- Deal support bonuses reward for the significant workload required to bring a transaction to closing or to compensate for post-deal integration work. In the vast majority of cases, deal support bonuses are paid in cash, with award amounts based on a percentage of base salary. Grants are typically paid once a given milestone has been achieved. For the deal team, that is often upon closing or shortly thereafter, and for post-deal integration awards, once the applicable goal or task has been completed.

- Value sharing awards reward key senior managers for maximizing shareholder value. Awards can be structured as a percentage of deal value, flat dollar amount, or fixed number of shares. These awards can be significant, and participation is typically restricted to senior management, including the CEO, who can have a more direct impact on the transaction value. Vesting and payment most often occur at closing with possible acceleration for a qualifying termination (i.e., involuntary termination without cause or termination for good reason).

Transaction and Retention Bonuses Disclosed in SOGP Filings

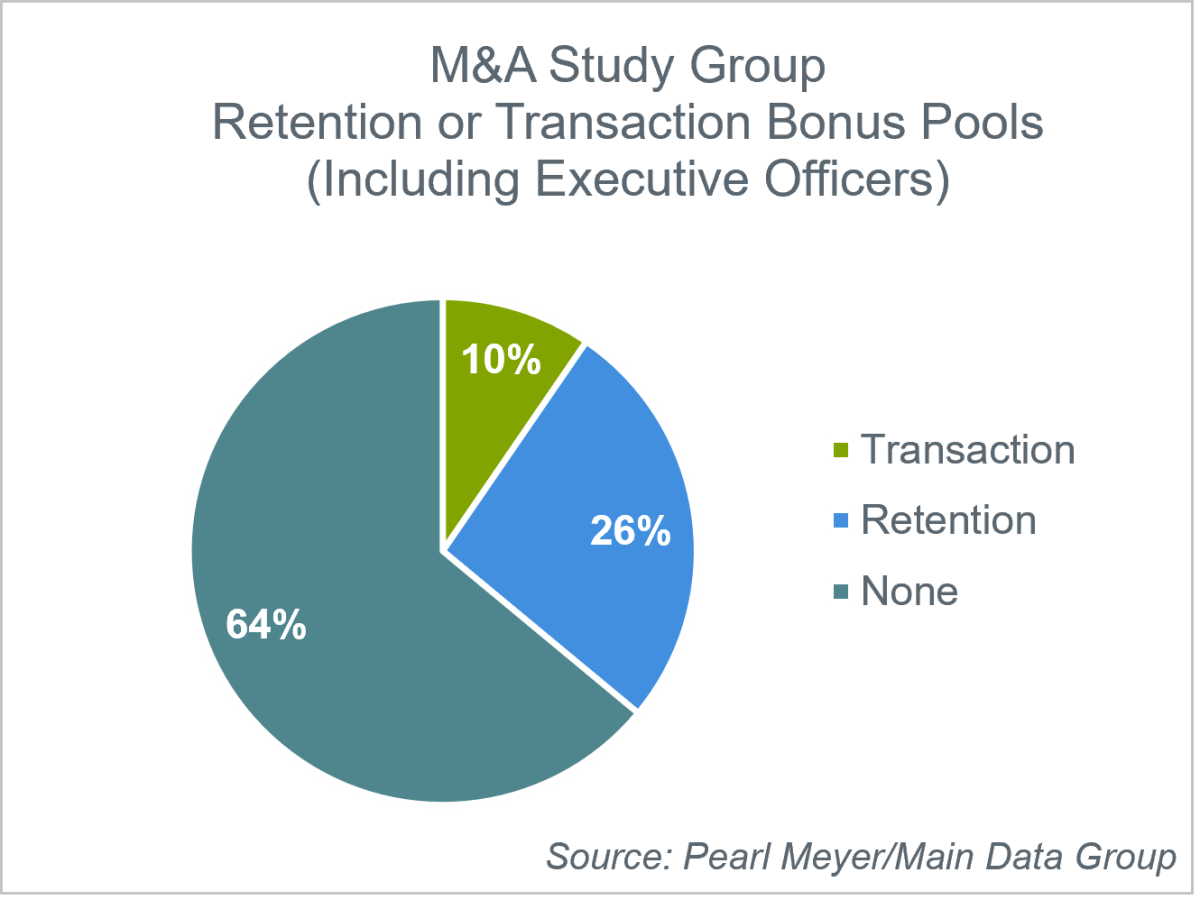

Our experience is that in anticipation of a transaction, most companies will reserve amounts to fund transaction or retention bonuses for employees below the executive officer group. Since the focus of SOGP disclosures is on payments or potential payments to executive officers and executive officers are often already protected by existing employment, CIC, equity, and/or severance agreements, not surprisingly, among the M&A study group, only 36 percent of companies disclosed retention or transaction bonus pools that included or could include executive officers.

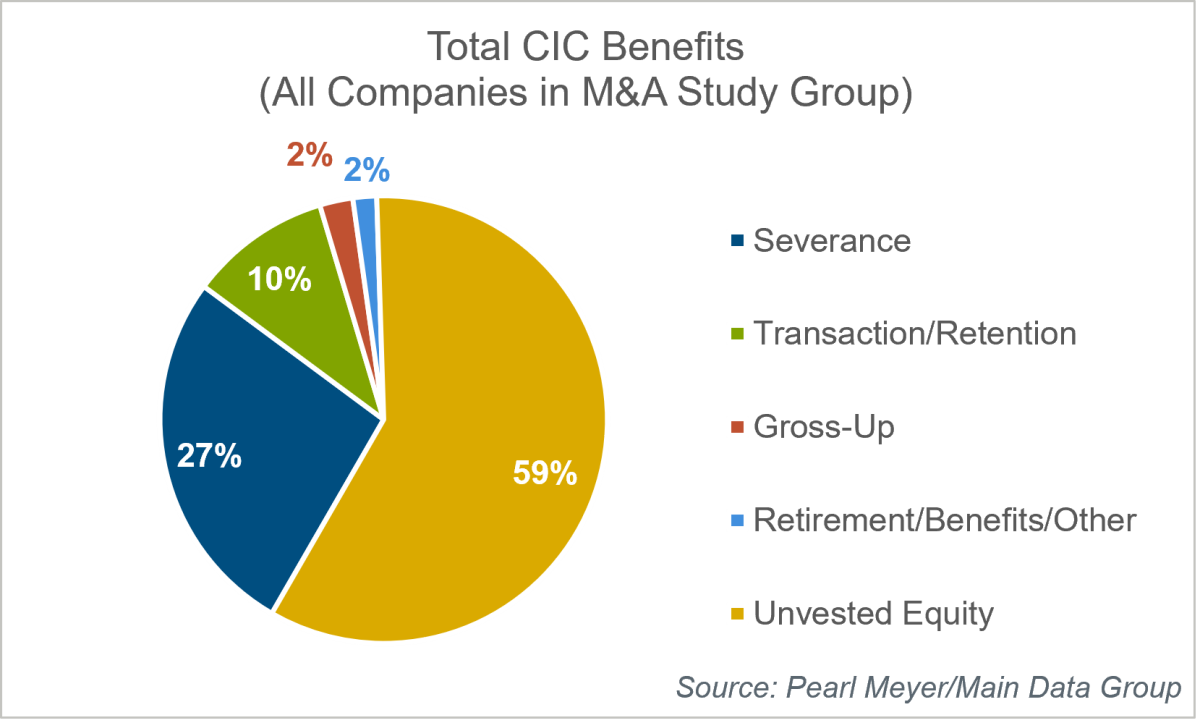

In the M&A study group, unvested equity acceleration and severance pay were the primary components of the total CIC benefits (including severance, equity acceleration, retention and transaction bonuses, retirement benefits, and other benefits), comprising 86 percent of the totals (severance, 27 percent and unvested equity, 59 percent). Retention and transaction bonuses comprised 10 percent of the total CIC benefits.

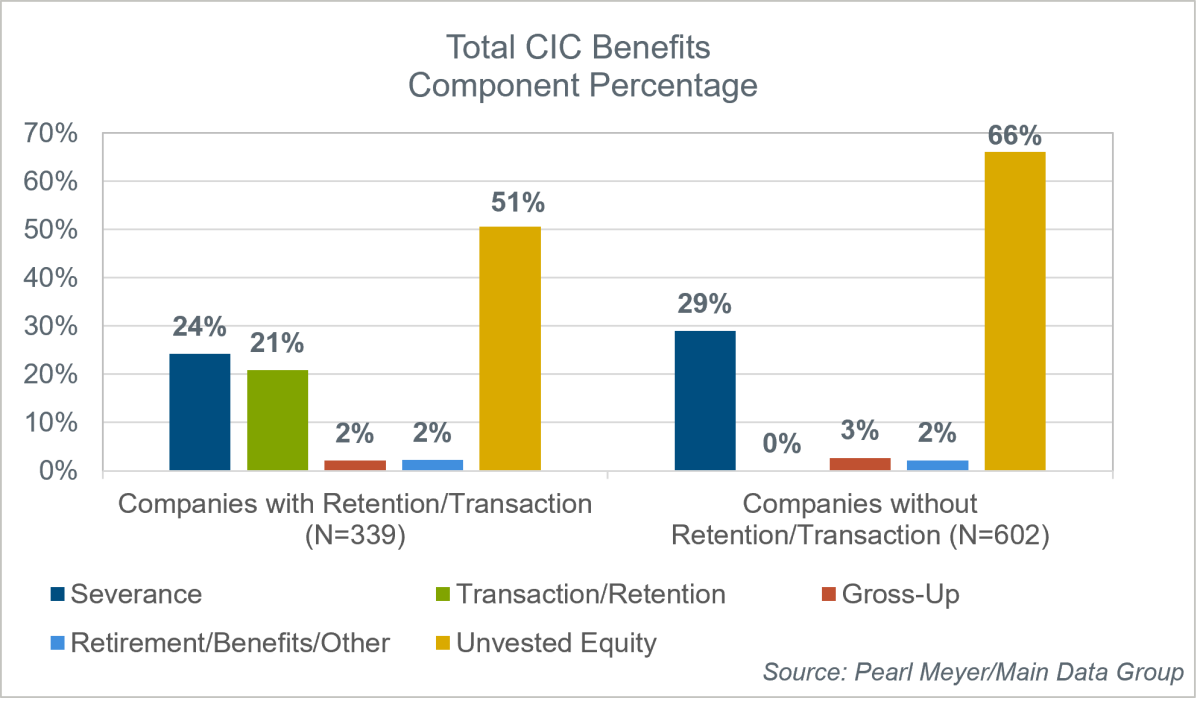

For the group of companies that did not pay transaction or retention bonuses, severance and unvested equity components comprised almost all of the totals (95 percent). Not surprisingly, severance and unvested equity were less significant in the group of companies that paid transaction or retention bonuses, comprising 75 percent of the total CIC benefits. The chart below illustrates the percentages of each component of CIC benefit received for the companies that paid retention and/or transaction bonuses and for those that did not disclose these types of payments.

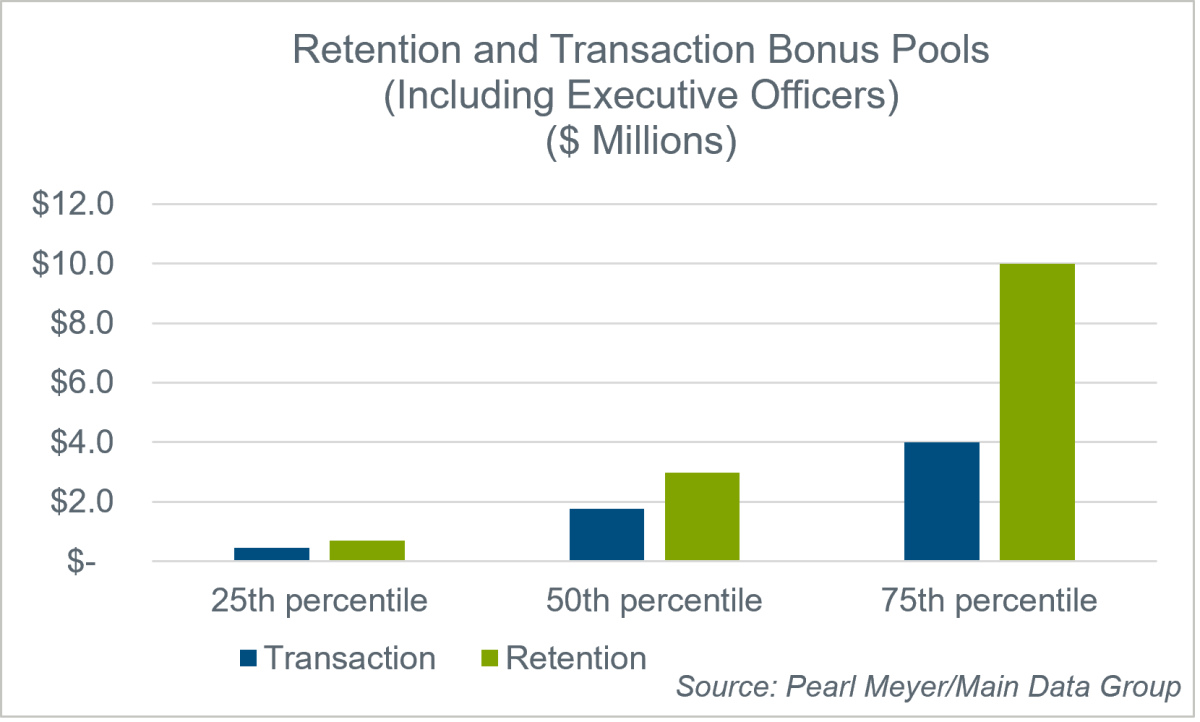

When provided, retention pools are the more common vehicle, and, as a result, more dollars are generally set aside for retention bonuses than for transaction bonus pools, which tend to target participation to a limited group. Participation in retention pools varied widely in the CIC study group, from a few select executives to a large group of employees.

In the full SOGP study group, dollar values of transaction pools varied between $.4M and $4M (25th to 75th percentiles), while retention pools ranged between $.7M and $10M (25th to 75th percentile).

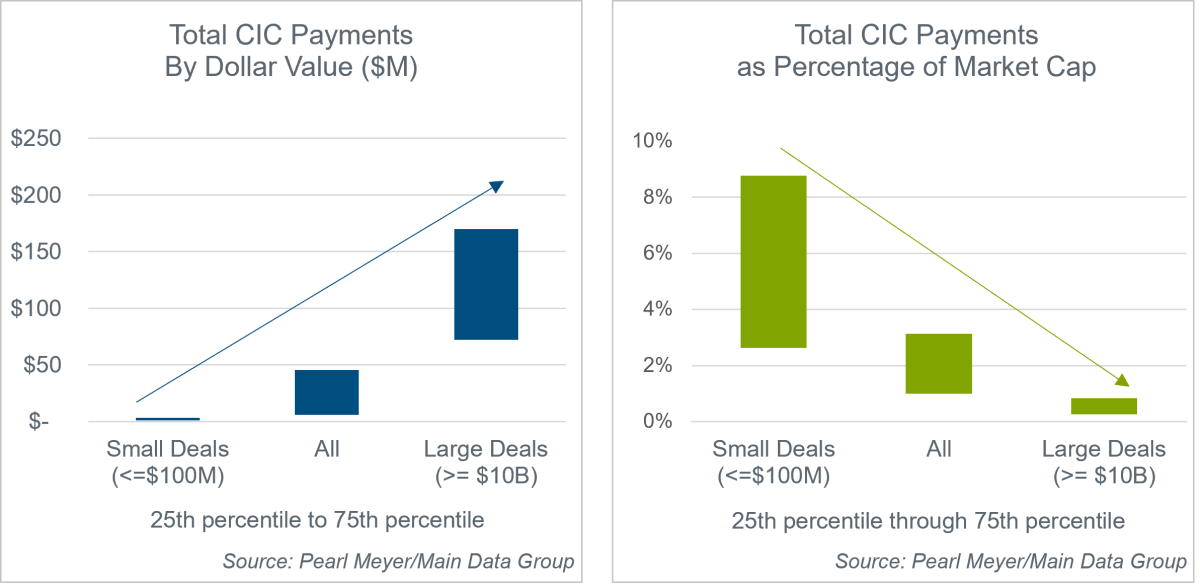

To avoid shareholder ire, when granting retention and transaction bonuses, compensation committees should be mindful of how the aggregate pool and total CIC costs relate to the size of a potential deal. Total company CIC benefits in dollar values tend to increase as the size of the deal increases; however, total company CIC benefits as a percentage of deal size, tend to decline as the size of the transaction increases.

In a similar vein, total retention and transaction pool costs as a percentage of transaction size tend to decrease as the transaction size increases, and dollar values rise as the deal value increases.

Conclusion

When a transaction is approaching, companies often turn to retention and transaction bonuses to fill the gap when their current programs are insufficient to keep management and key talent in place through the M&A process. Understanding whether and how much to pay for these benefits is critically important for compensation committee members.

When considering or establishing retention and/or transaction bonuses or any other new programs, compensation committees should be mindful of the total retention opportunities for the group, including potential severance and equity vesting upon termination or CIC. Understanding how the aggregate retention and/or transaction pool and total CIC costs relate to the size of a potential deal is also critical. By gaining an understanding of retention and transaction pool amounts and total CIC costs among comparative deals, committees can be assured of evaluating the best approach for a specific transaction.