Article | Jan 2025

Using Salary Survey Data to Benchmark Bank Compensation

Pearl Meyer’s 2024 banking compensation surveys provide essential data from 660 financial institutions to help employers navigate compensation decisions.

Determining the correct market pay for your top talent is a tall order. With uncertain political and economic conditions looming, employers are facing continued pressure on compensation levels. Many banks are also feeling the ripple effects of larger competitors boosting their minimum wage.

For reliable data to guide decision-making on compensation and HR practices, Pearl Meyer’s banking compensation surveys are an essential tool. The 2024 banking surveys collected data from 660 financial institutions, a 20 percent increase in participation since 2022. Data was reported by asset size for over 300 benchmark banking positions with several of our state banking surveys reporting data by specially developed geographic markets.

To support the administration of pay programs the Pearl Meyer banking compensation survey reports encompass several key facets of compensation:

- Base salary;

- Salary range;

- Short-term incentives;

- Long-term incentives;

- Actual and target total cash compensation; and

- Actual and target total compensation.

This data can be used to help banks realize the objectives of a strategic and well-designed compensation plan, including:

- To attract, retain, and motivate a sufficient number of people with the knowledge, skills, and abilities necessary to implement a unique strategy;

- To balance the rewards to productive employees with returns to shareholders;

- To provide employees with an opportunity to earn a living comparable to others in similar jobs at similar organizations in relevant market areas;

- To pay people in a way that is internally fair, comparing the relative contribution made by each;

- To determine consistently fair decisions in an efficient manner;

- To allow for the planning and controlling of the cost of human assets; and

- To comply with legal and regulatory requirements.

Putting the Data to Use

The HR department within any bank knows employees expect to be compensated at the “going market rate” for comparable positions, and employees themselves are savvier than ever with regard to compensation, as access to online salary data sources is becoming more common. Human resources professionals need to be well-informed by compensation survey data, and taking the time to answer the following questions can help frame your analysis and decision-making:

- What is your institution’s compensation philosophy and strategy?

- What are your market pricing strategies?

- Are these philosophies and strategies the same across all levels in the institution?

- Is there an existing salary structure and/or incentive plan(s), and how are they set compared to market?

- What are your geographic markets? What positions in your institution are geographically sensitive?

- What is your institution’s size and what positions are sensitive to size and complexity of the institution?

The next step in a market-based approach to pay is to select specific jobs for matching and compensation analysis. In compensation surveys these are known as “benchmark jobs.” They are common to the industry, have a standard and consistent set of responsibilities from one organization to another, and there is sufficient data to price in a statistically reliable fashion.

Job-matching is important to closely align the survey benchmark job description and your institution’s job description. As a best-practice guideline, if 75% of the core responsibilities reflected in the job descriptions match, then the two jobs can be considered a match, but keep in mind, the market is driven by the supply and demand of specific knowledge, skills, and abilities. Survey job descriptions are our best representation for collecting that value. It is recommended that you select and collect survey data on at least 50 percent of your bank’s positions.

After matching the benchmark jobs to your internal positions, you should select the survey data points that best fit your organization’s compensation philosophy and strategy. Most compensation professionals use the median base salary as the initial data point to collect and compare. Using the median for setting base pay keeps your bank’s compensation in line with the market. It is worth noting that some banks may utilize a unique strategy in which specific issues warrant not paying market; for example, budget issues may necessitate paying under market for some positions while the other extreme is paying over market to secure talent for a high demand or “hot” job.

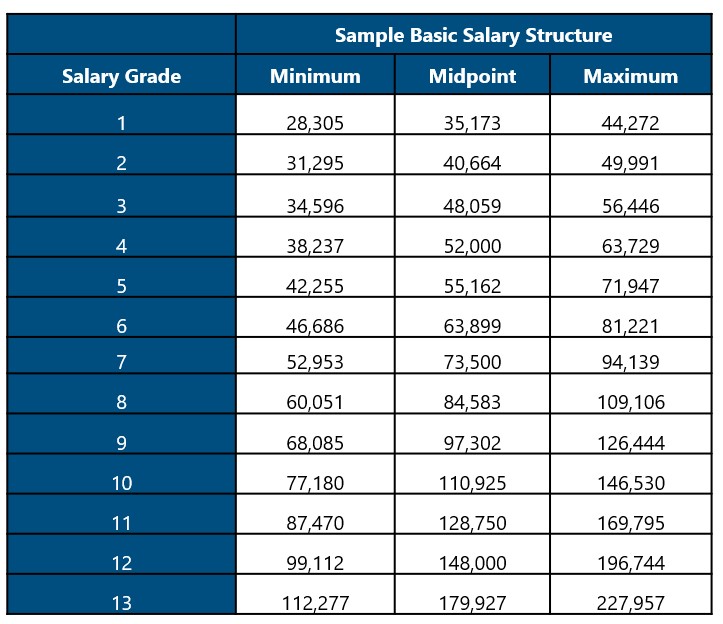

After collecting your data and completing a market pricing analysis, there are several additional steps and nuances to using the data in a formalized market-based pay structure. It should be noted at this point that some banks have the benefit of deeply experienced compensation professionals and may design pay structures in-house, but many more will choose to work with a consultant on designing a pay structure. In either case, the next step is to develop midpoints for each grade in the bank’s pay structure based on the data you selected for each job and assign each benchmark job to the grade with the midpoint closest to the data you selected for that job.

Now, how do you handle non-benchmark jobs for which you were unable to find market data? These jobs are handled by “slotting” whereby non-benchmark jobs are compared to priced benchmark jobs and are assigned a grade containing jobs of comparative overall job value (required knowledge, skills, and abilities). It’s important to consider the internal equity of your jobs when job slotting, which ensures consistent compensation for roles of similar responsibility level. For a simple slotting example let’s take a look at an Electronic Banking Job Family and sample salary structure:

- Electronic Banking Specialist (benchmark job) is grade 3 based on market data – Base Salary $47,000

- Electronic Banking Dispute Specialist (non-benchmark job) slotted in grade 3 based on knowledge, skills, and abilities – Base Salary $48,500

- Sr. Electronic Banking Specialist/Analyst (non-benchmark job) – slotted in grade 5 based on knowledge, skills, and abilities - Base Salary $56,000

- Electronic Banking Officer (benchmark job) – is grade 8 based on market data Base Salary $84,000

Once you complete the slotting exercise, all jobs within the bank should have a proper place in your salary structure

The final piece of the exercise is to set deliberate timing. How often should you review your bank’s compensation? Best practice indicates salary benchmarking should be at least an annual process; however, there are situations which would call for more frequent or additional reviews. Examples are hiring issues, reorganization, a change to your bank’s compensation strategy, etc. Benchmarking—which is far more efficient and certainly less costly than unwanted resignations—should be conducted regularly to stay aligned with market trends and prevent compensation-related turnover.

Pearl Meyer’s 2024 banking compensation surveys have been published and are available for purchase. The 2025 banking compensation surveys will open for participation in April of 2025. Also available, is our 2024 Banking Benefits and Human Resources Policies Survey and our Bank Director Compensation and Governance Practices Survey will launch in January of 2025. For additional information please regarding any of these surveys please contact Jordan Gagnon or Rhonda Snyder.