Advisor Blog | Jul 2022

Option Repricing or Exchanges in Development Biotech

For biotech, the retention value of options is currently in jeopardy. Here are several key points to weigh if your company is considering strong action.

Developing and early commercial biotech companies continue to suffer from the worst industry bear market in recent history. At current prices, many companies are finding that a majority of outstanding option balances are so materially out of the money that employees are not attributing any perceived value to these awards. There is no retention hook. For companies that went public in the last two to three years, this includes all public company grants and in some instances, certain pre-IPO grants as well. Given the recent hiring spree, management teams have raised concerns about retaining large swaths of their organizations, even as hiring in the biotech market is beginning to show signs of cooling slightly.

Throughout Q2, many management teams discussed potential retention strategies and programs with some opting to bring proposals to compensation committees for approval and implementation. Generally, these conversations considered one or more of the following:

- Supplemental cash bonus program;

- Supplemental equity awards;

- Modifying equity grant practices (e.g., pulling forward a future award); and

- An option exchange or repricing program.

The fourth tool is one that has generally been considered out of bounds since the last recession. It is, however, the most powerful and aggressive tool in addressing concerns about retention value.

There are a lot of strong opponents amongst shareholders, board members, and proxy advisors. Concerns typically center around the resulting disconnect between the employee experience and that of shareholders who must bear the entire loss in value. Nevertheless, increasingly more biotech companies are at least starting the conversation.

Depending on the structure of an option exchange, these programs can be viewed as being beneficial to shareholders more broadly. In fact, ISS will support proposals on a case-by-case basis if they adhere to a set of design parameters, including:

- Program must exclude executives and directors;

- Should exclude options granted within the last one to two years;

- Should exclude options with exercise prices below the trailing 52-week high for the stock price;

- Exercise price should be set at fair market value or a premium;

- Option should remain subject to the original term of the surrendered option; and

- Exchange should be done on a value-for-value basis.

ISS also considers the vesting of the new awards, whether the surrendered options return to the plan for future issuance, the timing relative to a precipitous drop in stock price, and the proxy disclosed rationale for the program and its design.

However, many companies find an issue with adhering to the ISS framework because limiting to these standards may fail to address key objectives for pursuing these programs. Companies wanting to move forward in other ways must do so knowing that they won’t receive ISS support or, if the incentive plan permits, do so without shareholder approval.

One point of caution: ISS is adamantly opposed to exchanges or repricings without shareholder approval. It views this as a problematic pay practice and comes down hard on director elections, say-on-pay proposals, and future equity plan proposals. Since a meaningful number of recent IPOs have this flexibility in their plans, this alternative is getting some consideration at internal company meetings.

There have been some early movers with three proxy proposals during this annual meeting season. We saw a mix of compliance and outcome.

Straight repricings without approval can fly under the public disclosure radar if executives are excluded. One early example from April of this year was GoHealth, which filed an 8-K because an executive officer was included in the program.

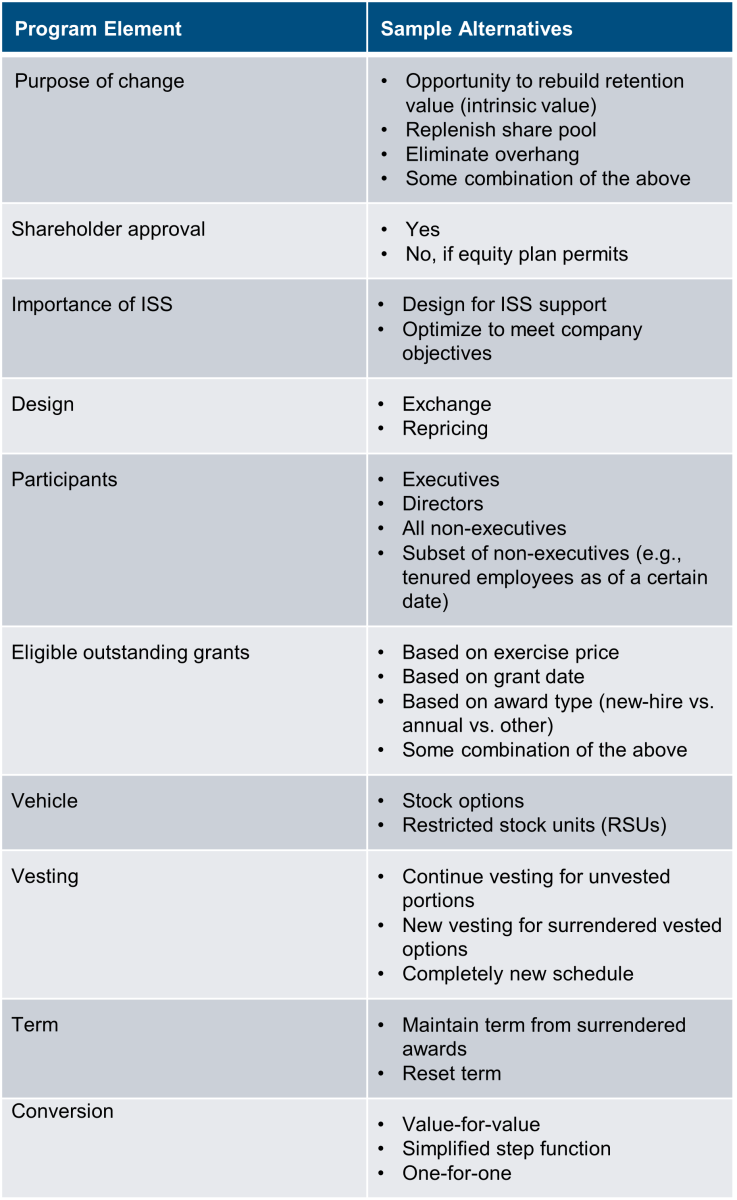

For companies weighing an exchange or repricing of any kind, the following ought to be considered in the discussion and decision-making process:

It is too early to say that this is a developing trend, but the fact that management teams are willing to seriously consider these types of programs highlights the angst around retention that many leaders are feeling. A prolonged market recovery may only increase interest in the topic, particularly amongst companies that don’t have near-term value creating inflection points (e.g., data readouts). As with all retention initiatives, though, management teams and compensation committees must try to gauge how well received the program will be and whether it will actually have the desired retentive effect. The worst result would be to go through the effort, incur the cost, and potentially subject the company to some external criticism, all to find that employees at large don’t appreciate or value the program.