Article | Aug 2023

Assess Your Bank’s Change in Control and Retention Fitness

With stalled M&A activity in the banking industry, this is the very best time to analyze your executives’ CIC and severance agreements.

Recent bank failures, the liquidity concerns of regional banks, and rising interest rates have depressed stock prices and stalled the merger and acquisition (M&A) activity of community and regional banks, which was at an overall high in 2021. In 2023, many banks and financial institutions have shelved their M&A plans while waiting for the markets and interest rates to stabilize. Although analysts generally speculate that M&A activity will remain cool in the very near term, some foresee increased banking regulation and divestiture of non-core business assets to be the outcomes of the recent events. This could result in a flood of change-in-control (CIC) activity at banks at some point in the near future.

Given that the best time to address compensation issues related to a potential CIC is when there’s not an imminent likelihood of being acquired, banks should seriously consider undertaking a thorough review of their current CIC and severance agreements.

Once a strategic transaction is on the horizon, this becomes very difficult, as compensation committees have limited time and are under heightened scrutiny to demonstrate the prudence of actions taken.

Reviewing existing CIC and severance provisions can identify obvious trouble spots far enough in advance for boards to take appropriate action. For example, companies can increase executives’ 280G “Base Amounts” and “Safe Harbors,” if warranted, by accelerating taxable income before year-end.

When a transaction becomes a reality, banks will need to reassess their CIC programs’ retention hold in the context of the actual deal being considered and fill any newly identified pay gaps with retention and/or transaction bonuses, which can help companies retain key personnel through a transaction, on a targeted basis, for a specified time period.

Phase I: The Pre-Deal CIC Assessment

It’s a common recurring nightmare: facing an exam for a course that was completely forgotten and never attended. That hopeless, unprepared feeling can strike executives and boards when a CIC arrives without warning.

In transactions, compensation nightmares can take various forms. Depressed share prices at some banks may leave equity awards with little “stick around” values. On the other hand, if equity grants have been made annually and a company’s stock price has risen significantly, executives may be surprised to learn that their CIC benefits will be significantly eroded by automatic cutbacks or golden parachute excise taxes.

Because many banks have implemented multiple CIC pay programs over the years, pay problems can be amplified. For example, it is common for banks to have CIC severance plans alongside supplemental executive retirement plans (SERPs) or salary continuation programs, and split dollar benefits that vest or provide enhanced benefits upon a CIC or termination following a CIC. When not regularly reviewed, CIC plan definitions and payout triggers may not be consistent, nor work as originally intended.

To avoid unnecessary problems, it's critical for companies and their boards to regularly review CIC plans and to quantify their IRC Section 280G exposures. However, because there is no real requirement to perform golden parachute calculations annually or as part of the annual proxy disclosure requirements (unless employment arrangements for named executive officers provide excise tax gross-ups), the difference between expected and actual economic benefits isn’t always apparent to either the executives or the compensation committee until a transaction is impending.

The IRC Section 280G “Base Amount” is based on an executive’s average five-year W2 earnings. IRC Section 280G applies when the present value of all payments related to the CIC totals more than 2.99 times the individual’s Base Amount (the “Safe Harbor”). When IRC Section 280G is triggered, punitive excise tax penalties apply for executives and what is referred to as “excess parachute payments” are also not deductible for the company. Layering multiple CIC benefits on top of one another, and increased CIC payouts, in combination with lower Base Amounts, increases the probability that at least one executive at a bank going through a deal will be adversely impacted by IRC Section 280G.

If addressed far enough in advance of a potential M&A, banks may be able to make adjustments to CIC provisions to ensure that a much greater portion of the intended benefit is delivered in a tax-efficient manner. Common planning actions considered by compensation committees include: adding contractual terms to cover the treatment of excise taxes or reductions in benefits; subjecting CIC payments to a valid and enforceable non-compete; accelerating the vesting of potential CIC payments in advance of a transaction; accelerating taxable income to increase Base Amounts and Safe Harbors, and other approaches.

Given the inherent complexity of CIC arrangements and the myriad of technical and contractual issues that are likely to arise when contracts are reviewed, payouts quantified, and adjustments considered, reviewing your bank’s CIC agreements and performing a few scenario-based 280G calculations may protect the bank from being caught off balance if an actual deal arrives without warning in the next couple of years.

Phase II: Addressing Pay Gaps – Retention and Transaction Bonuses in Banking M&A

Even when the best CIC planning processes are in place, pay gaps can emerge once an M&A transaction unfolds.

Each transaction being considered can impact whether existing compensation programs will remain sufficient to keep talent in place through the uncertainty. Financial buyers often intend to keep the existing management group post-transaction while strategic buyers may target specific overlapping groups or functional areas for significant employee reductions. In Merger of Equals (MOE) transactions (i.e., two banks of about the same size come together to form a single new bank), compensation committees often focus on equalizing the severance and various CIC benefits across the legacy employee groups.

With more clarity about the unique transaction at hand, alert committees will reassess their CIC programs and evaluate whether retention and/or transaction bonus plans are warranted. These programs enable companies to retain key personnel through a transaction, on a targeted basis, for a targeted time period.

Retention bonuses typically involve cash-based payments that are paid contingent upon continued services to a specified date. The awards can be structured to be paid regardless of whether the deal occurs, or upon completion of the deal and for some period thereafter. (For example, vesting 50 percent at closing and 50 percent six- or 12-months post-closing). Awards typically vest in the event the participant is terminated without cause during the retention period. In some cases, retention awards are issued in stock and vest over a period of several years.

Transaction bonuses are typically paid in cash or equity at closing or shortly after closing, typically within six months.

Market Practices

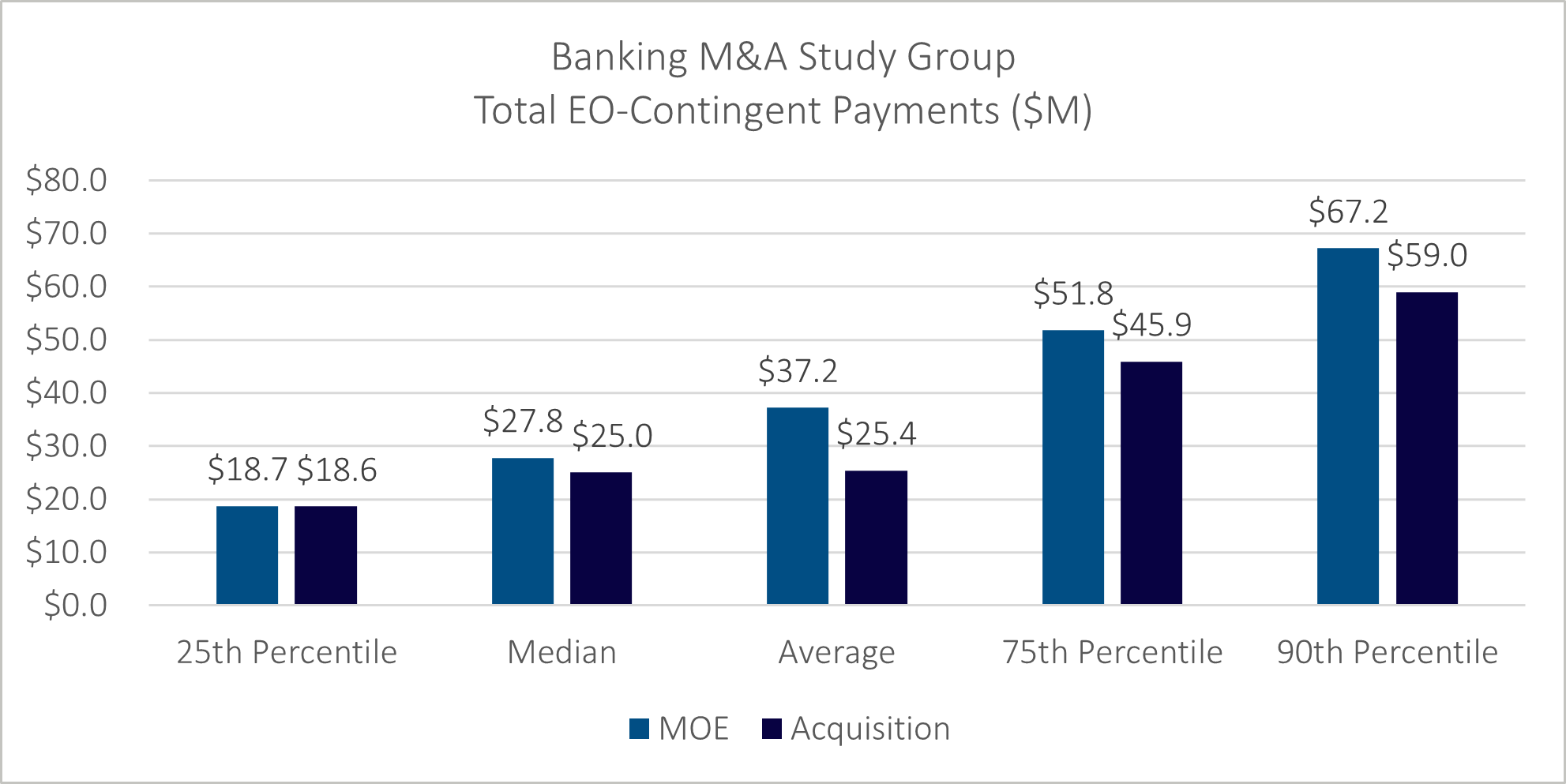

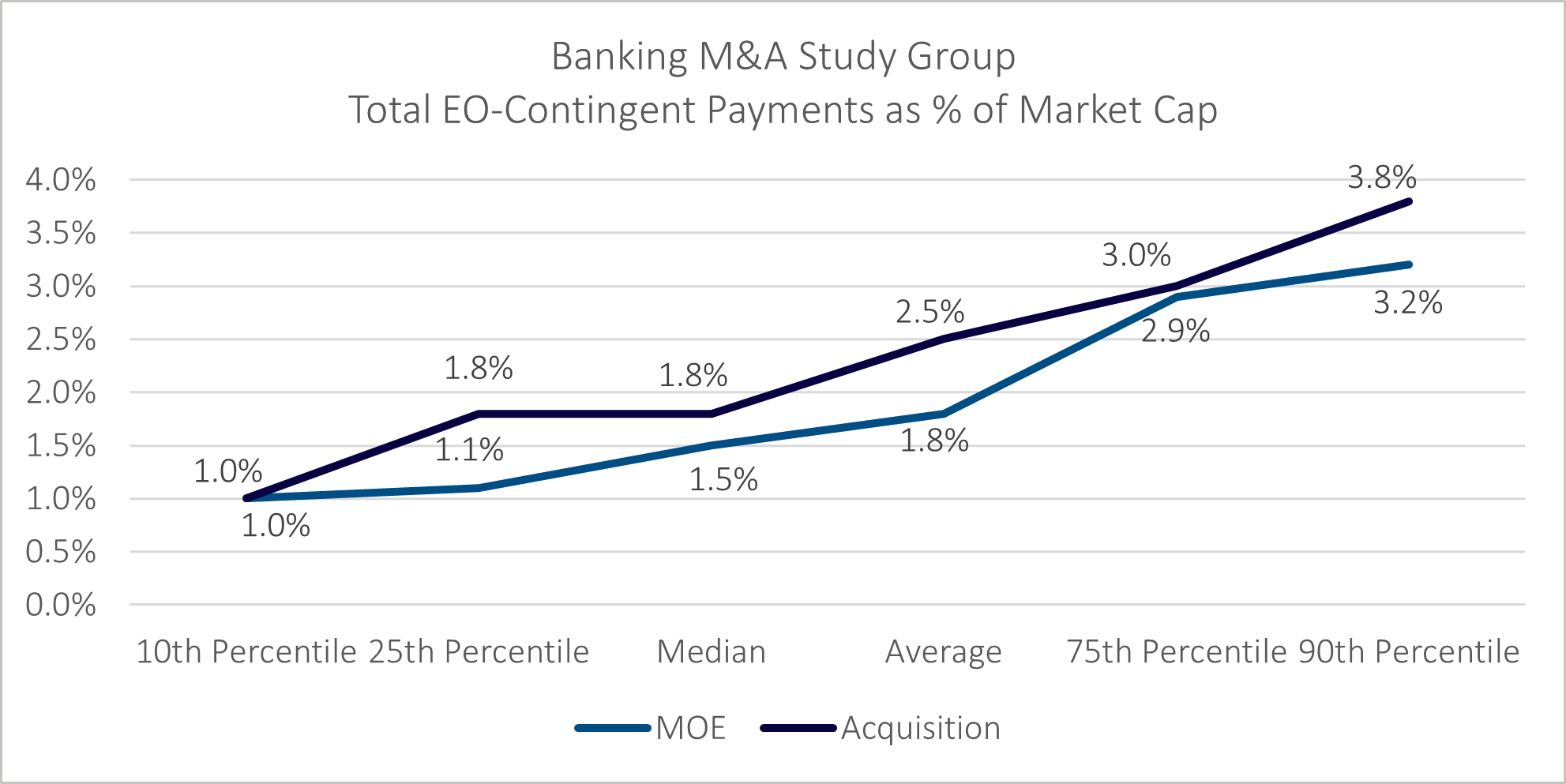

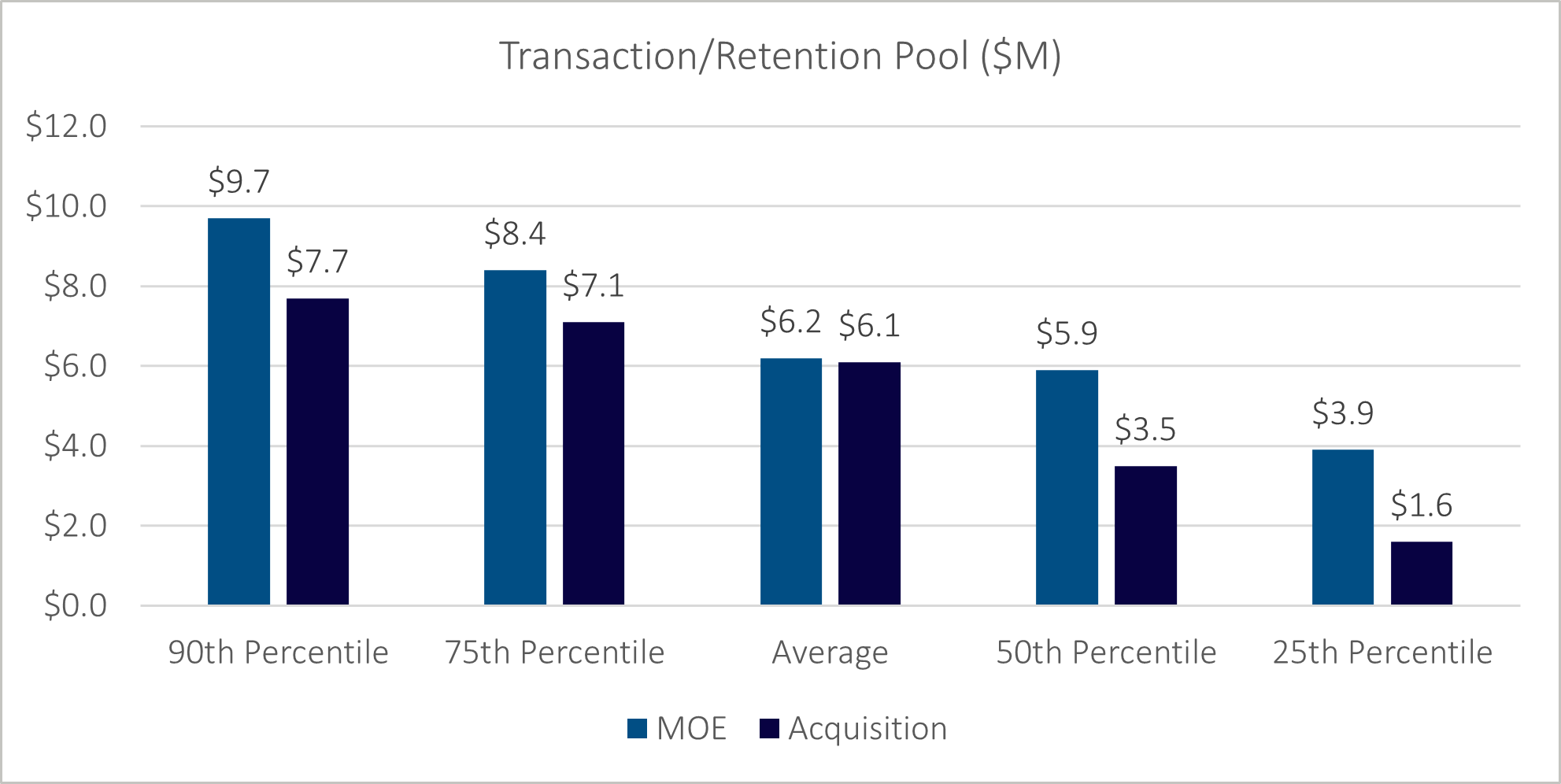

Understanding whether and how much to pay for retention and transaction bonuses is critically important for compensation committee members. To provide context on these programs, and to better understand how banks have sized retention and transaction bonuses in the M&A setting, Pearl Meyer and Main Data Group gathered information from say-on-golden-parachute (SOGP) disclosures of public banking transactions over the past seven years, from 2016 to 2022. The deals ranged between $200 million to $8 billion in transaction equity values and encompassed 54 acquisition transactions and 14 transactions considered MOEs. This dataset is referred to as the “banking M&A study group.”

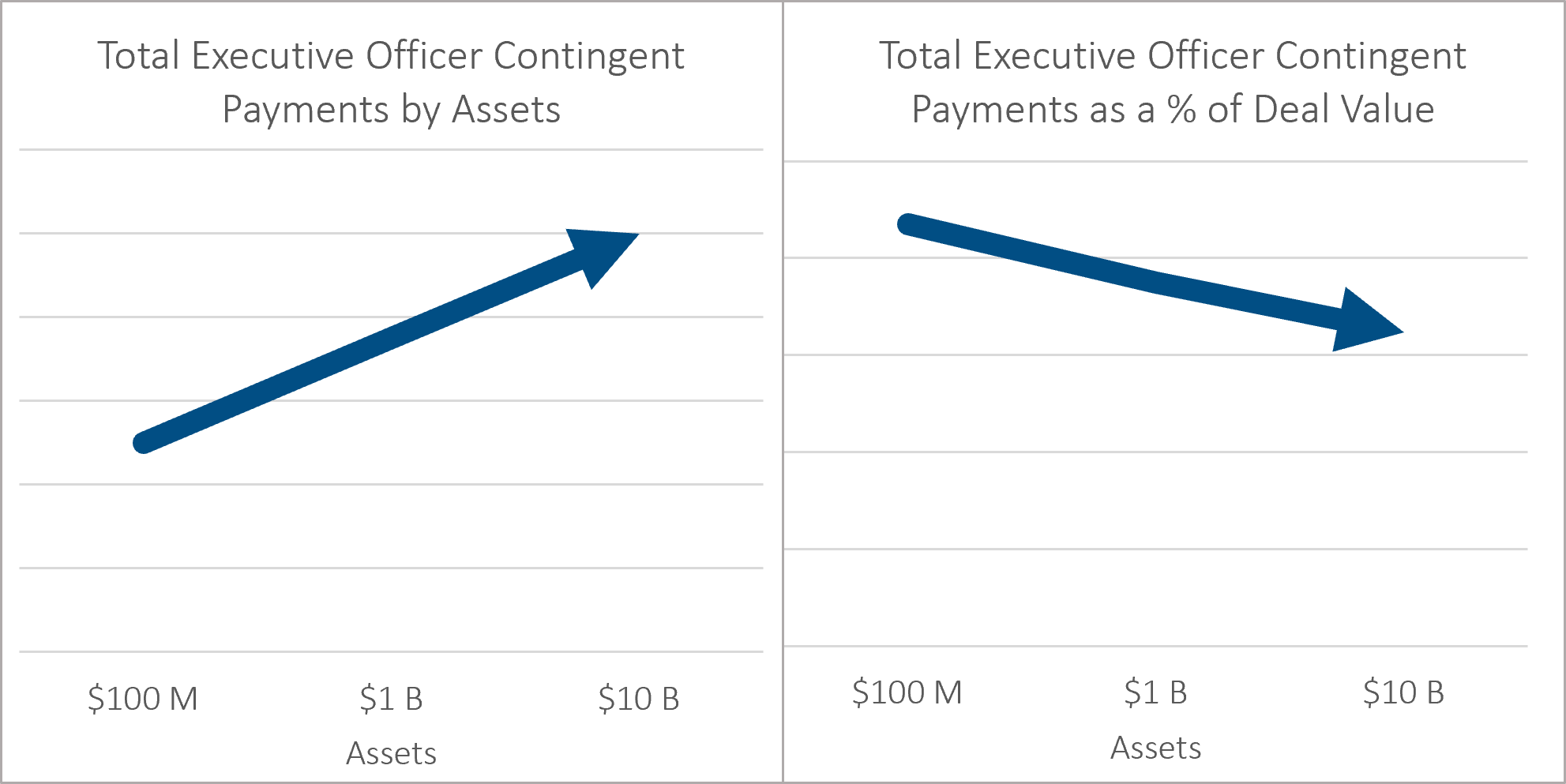

To avoid shareholder ire and unnecessary litigation, when granting retention and transaction bonuses, compensation committees should be mindful of how the aggregate pool and total CIC costs relate to the size of a potential deal. Total company CIC benefits in dollar values tend to increase as the size of the deal increases. While total company CIC benefits as a percentage of deal size tend to decline as the size of the transaction increases.

In the banking M&A study group, executive officer unvested equity acceleration and severance pay were the primary components of the total CIC benefits (including severance, equity acceleration, retention and transaction bonuses, retirement benefits, and other benefits), comprising 87 percent of the totals. The total value of all potential CIC payments is similar between MOEs and acquisition transactions (in aggregate dollar values and as a percentage of the deal size).

Our experience is that in anticipation of a transaction, most banks will reserve amounts to fund transaction or retention bonuses for employees below the executive officer group. However, since the focus of SOGP disclosures is on payments to executive officers, and these executives are often already protected by existing employment, CIC, equity, and/or severance agreements, not surprisingly, transaction and retention bonus plans are not always disclosed in SOGP filings.

MOEs were more likely to disclose inclusion of executive officers in the pool at merger vote by a significant margin. In the banking M&A study group, only 25% of the acquisition transactions reported that executive officers were participating in retention/transaction bonus pool as compared to 40% of the MOEs.

When disclosed, retention and/or transaction bonuses that were paid in cash were typically paid at close or within 24 months of closing. When granted as equity, the awards most typically followed the bank’s normal equity vesting schedule.

MOEs are also more likely to provide higher potential retention/transaction levels as compared to similarly sized acquisitions, in both aggregate dollar costs and as a percentage of the deals’ transaction equity values, which likely reflects the higher “at risk” retention issues given the merging of the two banks management team.

Key Takeaways

Although M&A is expected to remain cool in the near term, there may be a flood of CIC activity at banks in the near future. As a result, banks should consider putting a formal review and quantification of their CIC programs on their compensation committee agenda. Experienced advisors should be enlisted to assist with identified exposures. Taking these types of actions now could help avoid significant headaches when an actual deal arises.

Once a deal approaches, alert compensation committees will reassess their CIC programs in the context of the specific transaction being contemplated. Committees should always be mindful of the total retention opportunities for the group, including potential severance and equity vesting upon termination or CIC, before enhancing current programs. By gaining an understanding of retention and transaction pool amounts and total CIC costs among comparative deals, committees can be assured of evaluating the best approach for a specific transaction.